A candidate for Council in 2014 wrote one of those letters to the local paper that I just have to respond to. I know Harm, am a customer of his business, curl with him at the Royal City, and respect him very much. However, this letter is so full of wrong, I need to reply in my customary paragraph-by-paragraph basis. I like to quote people directly, because I don’t want to be accused of misquoting them. However, if I err in fact or in representation, I invite Harm (or anyone else) to reply here.

“In response to both Mr. Lundy’s (Why I’ll be voting ‘No’ in referendum, Inbox, Jan. 23) and Mr. Johnstone’s (Why I’m voting yes, Inbox, Jan. 28) letters about the transportation needs and plans for Metro Vancouver. The reality here is that the governance of Metro Vancouver is a mess! Twenty-two city governments, police departments, fire departments, and unelected Metro regional government and TransLink: A gong show that needs a serious overhaul.”

An interesting argument, but not apropos of the current Metro Vancouver Transit and Transportation Plan referendum. Since the Kevin Falcon era, many have been asking for a review of TransLink governance and a return to a more accountable elected board – no-one has called for that more often and vociferously than the Mayors’ Council. However, the Provincial government has made it clear they are not interested in exploring this at this time, and there is no reason to believe a NO vote will bring this about any more than a Yes vote will. I think I made that point in my earlier letter to Mr. Lundy, so I won’t belabour it here.

“The reality is that Metro cities are sitting on a massive cash reserve in the order of $5 billion as reported in annual financial reports to Dec. 31, 2013. Of the $5 billion, the five cities most serviced by SkyTrain hold $3.4 billion.”

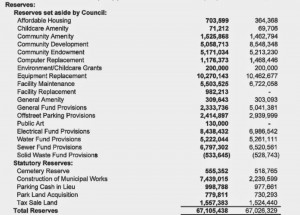

Let’s talk about reserves. If you would like to follow along, you can look at this document from the City website. The City of New Westminster has (or had at the end of fiscal 2013) about $15.7 Million in its bank account (“net financial assets”, Page 1 of the Financial Statements). That is derived from subtracting all of the things the City owes money on (invoices in our inbox + revenue we have deferred + money immediately payable on our debts, etc.) from the financial assets of the City (Cash in the bank + money people owe us + the money we have invested, etc.).

If you take away the fact we owe people money, and people owe us money, there are two more important numbers when thinking about the amount of money we have on hand. One is the “Cash and cash equivalents”, which was about $12 Million. The other number which kind of represents what we have in the bank is found on Page 8: $102M in Investments. When discussing “reserves”, this is the money we have set aside in various reserve funds, prudently invested and earning us a bit of interest income.

When we talk of “accumulated surplus” (Page 13), that is a different number, but $622M is a bit of a funny number, because it includes the depreciated value of most everything the City owns, including skating arenas, light posts and the furniture in the Mayor’s Office. I guess we could sell it all, but we wouldn’t really have a City anymore, would we?

“The reality is that the development of public transit infrastructure creates growth and, unlike traditional sprawl growth, does not cost municipal governments massive amounts of money to support. In fact the direct costs for public infrastructure directly related to density growth is charged back to the developers in the form of development cost charges, in reality a pre-paid tax which then becomes part of the purchase price of the units that are developed.”

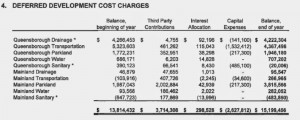

Correct, the City collects DCCs from development to pay for present or future infrastructure and amenity cost related to the new population pressure. By necessity, we do not spend the DCC the day we get it. We can’t, because most of the needs are cumulative, and many of them carry operating costs that cannot be carried until the population increase happens. See Page 8 where the deferred Development Cost Charges are itemized:

…and see how reserve funds are set aside for everything from Affordable Housing to Equipment Replacement to Water and Sewer funds (I don’t want to get into the whole Tax vs. Utility thing here as this is already too complicated, so for simplicity, assume it is all tax). I’ll come back to this discussion of reserves in a bit below.

“So, while we all know that municipal spending growth has far exceeded the increases in the cost of living, municipal tax revenues in the cities that benefit directly from transit infrastructure development has even outstripped these massive increases in spending.”

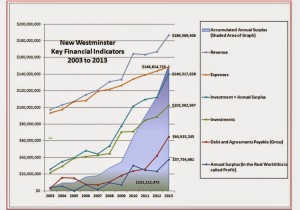

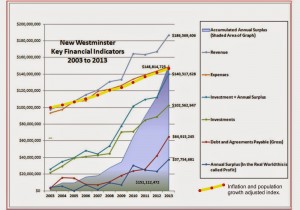

This sentence is simply false. A graph from Woldring’s own website shows how expenses have gone up between 2003 and 2013.

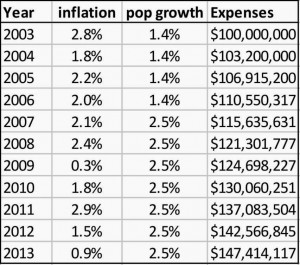

Indeed, all of those upward trends look concerning. However, Cities are subject to two types of continual growth: population and inflation. To understand the effect, I set an “index” value for City spending at $100,000,000 in 2013, and increased this value annually, factoring in only the inflation rate (which ranged from 0.3 to 2.9 over those 10 years) and the population growth rate in New West (based on census data, projecting the 2006-2011 trend up to 2013):

If you want to stop inflation and stop population growth, then we need to have a serious sit-down about Capitalism as an economic model, but this is probably not the right time or place for that.

“What we have here is a giant power struggle and a fight about taxpayers’ money.”

Well, no. What we have here are two levels of government trying to NOT tax at their own level to pay for services that people want. Mayors don’t want to increase your property tax, and the Province doesn’t want to raise your other taxes, but they both agree the project should be funded. Why? Because they are tired of having to explain to people that public services cost money to provide, because every time they say so, Jordan Bateman steps up and calls them all wasteful incompetents, to the cheers of a hundred CKNW phone-in “men on the street”. This letter to the editor is an example of that phenomenon.

“If transit development creates a “development dividend” for cities, some or all of that dividend should be spent on the continuing development of public transit infrastructure across the district instead of simply fattening the coffers of individual municipalities.”

Far from fattening the coffers, that dividend goes to providing the services people who are living in those developments will need – hence DCCs and expenses going up in parallel to population growth and inflation as seen in the graph above.

“The reason I’m voting ‘No’ is that the money is already there and the provincial government should wrest our money away from those municipalities and invest it in regional transit infrastructure with the emphasis being on moving people and goods using transit infrastructure like SkyTrain, LRT and short sea shipping instead of building more roads, tunnels and bridges. The people are ready; isn’t it about time politicos and bureaucrats stopped protecting their own turfs and do what we pay them for: serve the taxpayer!”

I ask the simple question: if the 5 cities cited above convert the entirety of their reserve funds, 100% of them, to the 10-year Mayors Plan (which would only provide 47% of the needed funding, so let’s assume the Federal Government matches those funds, and we get this done): Now what? (I’m going to, for the sake of argument, ignore the fact that some of these reserves are Statutory, meaning the Community Charter or other legislation limits our ability to spend them on whatever we want).

The letter invokes a picture of City hall having this big vault in the back where Mayor and Council occasionally roll around in piles of cash, all for shits and giggles. In reality, consecutive Councils have created and supported a long-term financial plan that will provide for the ever-increasing needs of the community (a problem made worse by downloading of so many senior government coasts to local governments) while assuring that future councils have the capital required for the huge pile of inevitable big-ticket items the City will need in the future without the sudden need for sharp tax increases whenever a capital project is needed. It is responsible governance.

“p.s. The new bridge to replace the Deas tunnel isn’t as much about cars and trucks as it is about getting bigger ships farther up the Fraser River, and since that’s the case, shouldn’t Port Metro Vancouver and the federal government be funding that one?”

This is hardly a PS. This is the central point. But I’ve been banging that drum for so long I’m tired of the rhythm.

*My turn for a PS: This is a good time to have the discussion about the City’s reserves, not because they would be better served bailing out the Province from their responsibility toward TransLink, but because we are going into a budgeting cycle in the City where Council may ask taxpayers for yet another increase, and some of the money that increase will bring in will go towards reserves. The letter writer clearly believes these reserves are getting too big, I have talked to a Charted Accountant who has some experience in Municipal finance, and (after a cursory review of our 2013 Financial Statements, and admitting he didn’t know much about the pressure on New Westminster’s physical resources) he suggested they were moderate, or perhaps a bit low, and he is not alone in that feeling. We need serious talk about reserves and how we use them, for the long-term good of the City.