I really have a lot to do in New West these days, but I’m going to take a few minutes here to sum up Day 2 of the provincial election campaign. Because it was too harrowing to ignore, and some of you wise enough to avoid Twitter might have missed some of it.

There was some sort of housing talk in New Westminster today, invite-only for the Real Estate industry, so I wasn’t there, but the weirdness of the news coming out of it makes me pretty glad I wasn’t.

Rich Coleman had a rough day. When asked to provide advice to young people growing up in Vancouver, his advice (Quoted by Frances Bula:)

Coleman: My advice to my teens, start saving for the down payment for your first time. That is your future if you can build up that equity.

— Frances Bula (@fabulavancouver) April 12, 2017

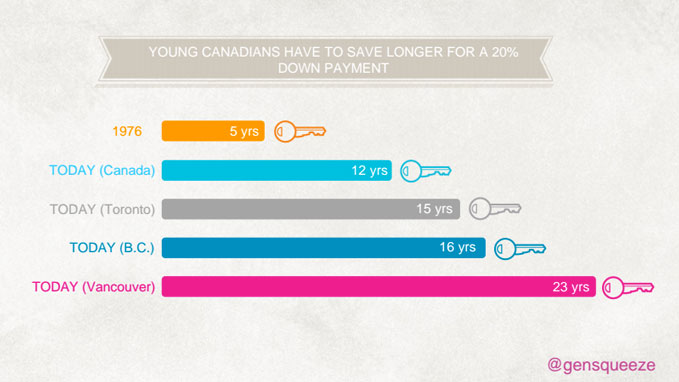

It didn’t take long for people to point out that teens today also need to pay more tuition than his generation did, have much higher rental costs until they get to that down payment, and have little secure employment due in part to the growth of the gig economy. According to the data crunched by Generation Squeeze, a teen today is more likely to have a teen themselves before they save up enough money for a down-payment in the overheated Vancouver real estate market:

He followed this up by announcing the BC Liberal plan to address the decimal-number-lower-than-one rental vacancy rate and rental-costs-spiraling-out-of-reach-of-most-workers-in-Vancouver crisis he has largely ignored in his decade as Minister in charge of housing. This would be to give money to people who already own houses – a $20,000 credit to fix up their basement suites.

John Horgan also felt some largess today, announcing the NDP will offer an annual $400 Tax credit to renters. Not enough to offset rental increases, of course, but a bit of a balm to renters who feel the much larger homeowner grant is a subsidy to something they cannot afford to own. The Premier’s quick reaction was to suggest that this would only “line the pockets of wealthy tenants”.

Chew on that for a second: $20K to homeowners = help for renters; $400 to renters = only helps the rich. Are these people insane?

The housing crisis is nothing new, it has been a slow burn for a decade. But many competing forces have been pouring gasoline on it until it has replaced transportation as the biggest issue in the largest population centres in BC. Our housing system is broken, and Coleman, after a decade, has not been able to come up with a coherent plan to fix it, or even demonstrate that he understands a problem exists.

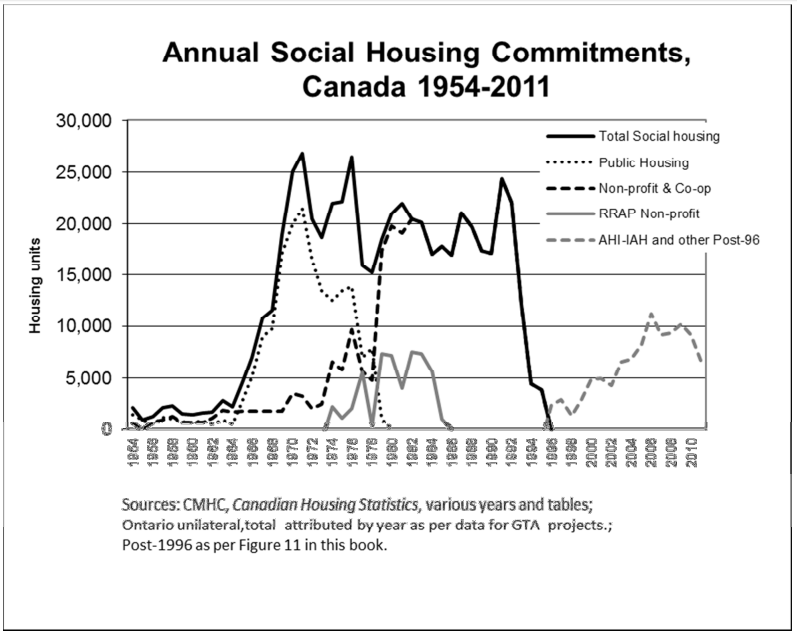

When managed by “free enterprise”, housing cannot be both a great investment and affordable. If it is the first, it must rise in value faster than inflation plus mortgage rates, otherwise you lose value investing in it. Anything that increases in value that much faster than inflation must soon become unaffordable. Our governments used to manage this issue by building housing for those without access to the capital to invest. They built subsidized housing for the poor and working class, they invested in Co-op model housing so communities could securely work together to provide a wide range of housing, they built student housing and seniors housing. They used to run rental buildings for those with few other options. Then in 1990s came along:

Now we have a fractured and disjointed system. Cities try to help, mostly by providing land and incentives, but with 8% of the taxes of the senior levels of government and increasingly complex Cities to run with that 8%, they are pretty limited in their effectiveness. A large number of not-for-profits and social service agencies try to string together grants and donations to operate what buildings they may be able to secure in this crazy market, then beg for a few crumbs from Rich Coleman to keep them running sustainably. All along, the Government has never provided a strategy, a comprehensive plan, any kind of vision. Random acts of funding are doled out (sometimes to agencies that have already folded for lack of funding!) so the Government appears to be doing something.

If you need just one reason to vote NDP this election, it is to get David Eby into government. No-one in the region has spoken as clearly and forcibly about the housing crisis – even back during last election when everyone else was talking LNG and Transit, Eby knew what issue #1 in BC was going to be by 2017, because his riding was at the front of it. He has brought a rational voice to it, against the insane ramblings of the BC Liberals. This guy needs to be in government:

That said, Eby’s not running in #NewWest. But if you want to meet your local candidates and talk about housing, the local affordable and family-friendly housing advocacy group Yes in New West is hosing an All-candidates event with Tenth to the Fraser on April 28th. It is free, but you need to register ahead of time because they plan to make beer and wine available, and for all the announcements, John Yap didn’t really make liquor laws that much more rational:

I’ll leave aside the politics and the questions of how ‘free’ enterprise is when certain are capped while others are not, and you need government approval just to change the railing on your front porch. Here I want to focus on one particular statement: “If it is [a great investment], it must rise in value faster than inflation plus mortgage rates, otherwise you lose value investing in it.”

This statement is economic hogwash. You are saying an asset must rise in value faster than inflation and financing to be a worthwhile (or great) investment, ergo any depreciating asset cannot be a great investment. If that were truly the case, society today would not be far removed from our nomadic roots.

Saying “it must rise in value faster than inflation plus mortgage rates, otherwise you lose value investing in it,” ignores the effects of any cashflows in between acquisition and disposition. It ignores the differential between rents and purchase prices. It ignores the effect of taxes. It ignores the cost of other sources of capital beyond the mortgage. And given that it is a financed purchase, it gets the effects of inflation completely backwards.

Heck, it even ignores what the goal of the investor is in making said investment – it’s not always about return on investment. Depending on those (and more) factors it’s entirely possible to invest in a house that does not inflate appreciably, or even deflates in price while still gaining value.

Even at today’s prices in Metro Vancouver, assuming housing appreciation just matches general inflation, and ROI is the main criteria, housing can be a good, if not necessarily great, investment. Go to a market outside of this bubble and your options are even better.

See, Jen? Why every time I try to write shorter blog posts, one that will avoid the dreaded TL;DNR label, some pendant comes in and writes a screed that takes one clearly condensed version of a very complex thought and blows holes in it. Alas, it is either this or going back to dull Blair King length blog posts no-one makes it more thna three paragraphs into…

Thanks Mark, I recognize that the economics of housing investment is a complex idea, and that there are many motivations and factors that influence it. However, boiled down to its very short essence: the economic structures we have actively created to make “housing your best investment” are the same structures that require us to take active measures to assure there is a non-investment supply of housing for those not fortunate enough to be making long-term investment plans with their limited paycheque. And thank you for leaving aside hte politics in a blog post that was 100% about politics.