RA asks—

This past year the assessed value of my property has increased by $150,000. Approximately a 30% increase. Using the property tax estimator, entering a rate increase of 0% results in an increase of my tax payment of 18% due to assessed value increase alone. Therefore this more than covers the 2.67% the city proposes. I understand that many homes faced similar increases this past year. For these reasons, I am not in favor of the tax increase proposed.

Can you tell me how the city has factored in the large assessed value increases into its budget and resulting proposed tax increase?

Wow. 30% in one year is crazy. It would be nice to think you made $150K this year just sleeping in your bed, but that doesn’t do you much good if you can’t sell – you have to put that bed somewhere. However, the short answer to your question is: it hasn’t. The longer answer is below.

Your assessed increase was significantly above the average increase in property values for the City over the last year, which was 11.7%. This means you are going to get dinged by the property tax system more than most. However, that doesn’t mean the City is getting extra money, it means someone out there in New West must have got an assessment increase less than the average, and they will see a relative tax savings this year.

The better way to answer your question is by going through a quick example of how the Assessment/Mil rate tax math works.

First off, the City has not yet settled on a tax increase this year. The current draft of the 5-Year Financial Plan that needs to be done by May (the “budget”) is built around a 2.73% increase. That is (more likely than not) the number that is going to come to council in the form of a Bylaw sometime in April. This means the City plans to collect about $1.8M more this year than we did last year in order to balance the budget. About $1.3M (1.97%) of that is “base budget” increases – inflationary increases that, if not approved, would result in a reduction in existing programs and services. The other approximately $0.5M (0.76%) is new departmental requests: things like additional staff to enforce and administer the Tree Bylaw.

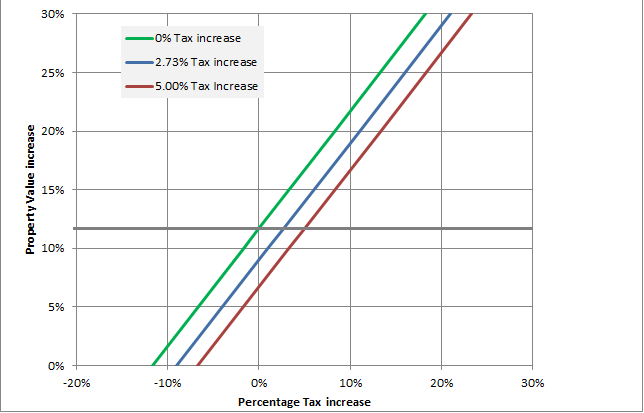

Using the City’s handy tax estimate calculator, you can enter 2.73% and your assessed values from 2015 and 2016, and get an idea how much your taxes are likely to rise this year. For the fun demonstrative value of it, I entered several values for property assessment increases and City tax increases, and plotted out the results:

On the Y-axis (vertical) is the property value increase from BC Assessment. I don’t think many properties went down in value, and your 30% is the highest increase I have heard of, so this should cover most of the range of residents in the City. The average increase City-wide was 11.7%, which I show with the thick grey line. On the x-axis (horizontal) is the amount your tax bill will increase based on the three scenarios represented by the green line (City tax increase of 0%), the blue line (the City’s proposed 2.73% increase) and just for comparison, a 5% tax increase shown with a red line.

You can see that for the average assessment increase (11.7%) the tax increase is equal to the City’s set increase. As your assessment increase is an astounding 30%, your tax increase is going to go up much more than this, and the relationship is linear: if we raise taxes 0%, you will pay 18.3% more, raise taxes 2.73% and you will pay 21% more, raise them by 5% you would pay 23.3% more. My assessment went up about 17%, so my numbers would be 5.3%, 8.0% and 10.3% respectively.

However, 11.7% is the average increase for the City, so for every property that increased more than 11.7% there is one that increased less than 11.7%. For the owner of a property that went up 10% in value, the proposed tax increase is about 1% (less than inflation), and any property that increased by less than 8.7% in 2016 will see their taxes go down. I know you are sitting on a 30% increase and the regional real estate numbers are crazy, but by the virtue that your property went up almost 3x the average, there must be a large number of properties in the City whose increase was less than the average, and even below that 8.7% threshold.

To sum up, the big point here is that the City does not look at the assessed property value increases when calculating the tax increase required for the year. We look at our budget and determine what our need is to deliver the services required. This year it looks like about $1.8Million, so for every $100 we took in from property taxes last year, we need to take in (about) $102.73 to deliver those services and balance the budget. If the average property assessment was 1% above last year or 100% above last year, it does not change that 2.73%, and the only thing that increases or decreases your tax burden is the amount your property increased or decreased in value relative to the city-wide average.

If you think a 30% increase is not realistic, then you are able to appeal it. Too late now for 2016, but 2017 is just around the corner. The BC Assessment office doesn’t work for the City, so we have no say in how they do their work, but there is an appeal mechanism, and if you think your out-of-scale assessment is wrong, you can appeal. If you were to get your 30% increase appealed down to 20%, you will cut in half the amount of tax increase you experience. As a City, we have no skin in that game (because every one of your neighbours’ taxes will go up slightly to offset your reduction), but as homeowner whose assessed value went up 17% last year, I’ll be sharing your pain.