Brian asks—

How much of New Westminster tax revenue is generated from business vs. residential? How does it compare to other municipalities? Is this a key driving metric to ensuring sustainable tax revenue for the city? What does the city of New Westminster due to attract new business to bolster higher tax revenue from new business? Is there anything else residents should know about how the city works with it’s businesses?

I’ve written a little bit in the past about the proportion of property tax that is collected from business/industrial properties compared to residential. I tried to compare here in this blog post a few years ago, and since then the numbers have changed a little bit, but the overall theme hasn’t.

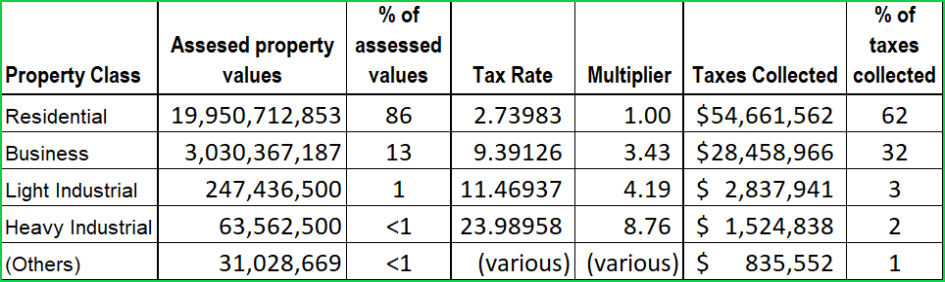

The simple answer to your first question is 38% of Property taxes are from Commercial/Industrial land and 62% from Residential land. At least this was the split in 2020, according to the statistics collected by the province and reported out annually in a table they call Schedule 707 that you can look at here.

Property taxes are based on assessed values, and more than 99% of our taxes are collected from lands under the four main property classes. Residential properties pay the lowest rate, and the other three classes pay a higher multiple of that rate. In 2020 the multipliers were 3.43x for most Business properties, 4.19x for Light Industrial, and 8.76x for Heavy Industrial. That said, most of our land is residential, so to pull numbers out of Schedule 707, here are where New West property taxes came from in 2020:

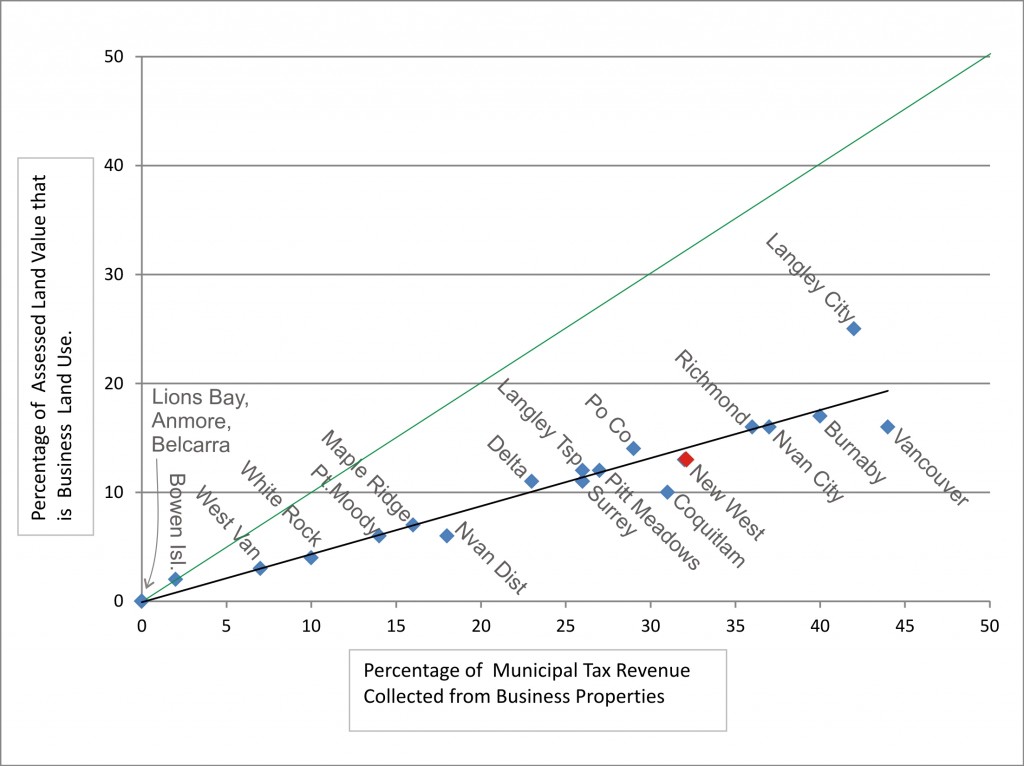

In that last blog post where I talked about this, I compared New West to other municipalities in the Lower Mainland and found our business/residential breakdown was slightly less “business friendly” than the average across the region, in that we drew 32% of taxes from the 13% of assessed land value that was zoned commercial (not including industrial), which is slightly more than the average. I showed this by plotting all Cities and showing that New West fits a little below the black “best fit” line that represents the average:

If you want more details about how we compare, Schedule 707 shows this data for every City in BC, but there are some fundamental differences between the property tax structure in the Lower Mainland when compared to the rest of the province (e.g. the great TransLink-Hospital tradeoff, resort municipalities that have different structures, and “company towns” like Kitimat that have no residential property tax at all) so approach direct comparisons with caution!

The simplest answer to your second question is probably “partly”, but as always it is more complicated than this. The way the City sets tax rates is to determine what it will cost to offer the services and infrastructure that we want to deliver in the following year (and within the next 5-year plan). Then we have some debate about what things we can do without for now vs. what things we set as priority, and that discussion occurs within the framework of the overall property tax impact. Mostly, those conversations sound like “If we decide to do X in 2021, it will mean an additional 0.04% tax increase”. If we did everything we wanted to do in fiscal 2021 that our budget discussion considered at the beginning, the tax increase would have been almost 11%; if we had kept the tax increase to 0%, we would have had to cut programs and lay off staff. So we look at programs, and negotiate between us (and with staff) about what we can do, and what the tax impact is. In 2021, that haggling got us to 4.9%. And yes, those discussion are all done in open Council meetings and open workshops. In New West, we simply don’t do budgeting behind closed doors.

However, that 4.9% does not mean everyone’s taxes go up 4.9%. As I outlined in this post, it means the City collects 4.9% more property tax money than the previous year, and because your taxes are based on your assessment, the amount of increase you see depends on how your assessment changes relative to the city-wide average. This also applies to business, as some years residential assessments go up more than business assessments, and other years the opposite. The proportion of the 4.9% increase businesses feel depends a bit on that. Except that one of the things the City’s finance department does when it gets the new assessment data, after it has set the overall increase, is to try to adjust the multiplier (see that table above) so that the business/residential proportionate tax contribution stays around 38/62.

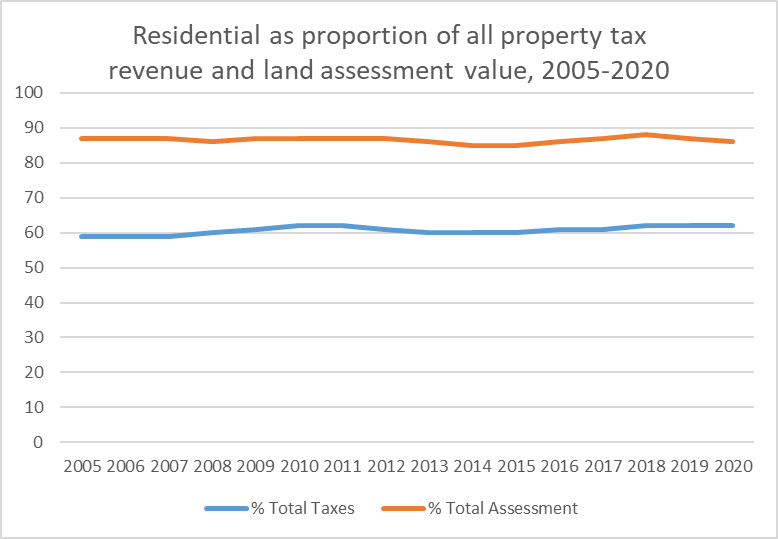

Every year, Council could adjust that 38/62 proportion by simply asking Finance to make that adjustment differently, effectively asking Finance to adjust the multiplier so businesses take a bit more of the load, or a bit less. Of course, we would then be deciding whether we irritate business property owners or residential property owners, because reducing business taxes through this process means increasing residential taxes. As a result, that proportion has not changed much over the last 15 years:

Again, this table is Schedule 707 data, and it shows that in 2005, Residential properties represented 87% of total land value, and paid 59% of total taxes. In 2020, those numbers were 86% and 62%, and it has only wavered a percent or so back and forth over those decades (and several different Councils).

Question 3 could have a very long answer. The City has an Economic Development group, and staff who do that work. You can see their website here. Obviously, the last year or so, a lot of effort has been put into assuring the City is providing supports to keep impacted businesses operating during the pandemic, which includes keeping business informed about the Public Health Office orders and complaints or concerns in the City related to the business sector. However, “bolstering new tax revenue” is not really the lens through which this work is done. At least in my time on Council, the focus has been on seeing business as a functional part of the community, and an amenity that supports the functioning of a dynamic urban area. In synch with the City’s other major strategies (like those on housing and transportation) a strong business sector reduces the need for residents to travel long distances for their needs or their work.

So, in that sense, asking what the City is doing to support business is like asking what is the City doing to support housing, or recreation, or engineering. There is too much going on across that department to summarize in a blog post. However, the ED group has a Strategic Plan, and have an on-line dashboard tracking their Indicators to help them and the community understand if they are meeting their objectives. If there is more to know, it is probably in there.