The other big story last week in New Westminster has been the City’s decision to move ahead with the development of a primo Class-A office tower on top of the MUCF, despite the loss of the developer/funding partner, Uptown Property Group.

Part of why I have been so reluctant to comment on this issue at length is that I don’t know enough about the discussions behind how this decision was made, the foundations of this being Real Estate Negotiations, much of it is (perfectly legally and legitimately) done in camera.

I have talked to a lot of people about this in the last week, have watched the online coverage of council, and listened to a lot of the rhetoric. Of course, no knowing what the real back story has not stopped a whole bunch of people twittering up a storm about how this was the Final Betrayal of this Council, and one particularly excitable individual even suggesting we need some sort of Recall Initiative for the 4 councillors and the Mayor who voted for this (an initiative idea which does not, I note, exist under the Local Government Act.)

Almost all of the rhetoric we have heard about this in the Social Media has been, lets say, factually challenged. So now that I am adding my idiocy to the mix, I should probably admit up front I am no more or less informed that any other random schmuck spouting off about this. Still, here is the way I see this:

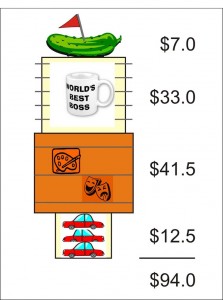

The City has a big hole in the ground Downtown, and has a limited time to use $35 Million of “Casino Money” to fill it. The meat in the MUCF burger is the large Civic Complex, which will cost $41.5M to build. On piece of bread is $12.5 million worth of underground parking (which is a whole different topic worthy of discussion, but I’ll note even the most strident conservative has yet to complain about socialist parking, unless it is pay parking, which is somehow too socialist). The top piece of bread is $33 Million worth of aforementioned Class-A office space. The pickle on top is $7 Million in “office improvements”, to make those offices actually leasable. That adds up to a $94 million sandwich of woe.

|

| All figures in Millions of Dollars. |

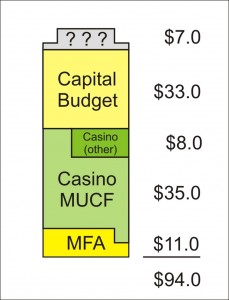

The second side of this equation is how we are going to pay for it, and this is where things get a little fuzzier. The first “up to” $11Million is to be borrowed from the Municipal Finance Authority to cover most of the Parking Garage Cost and shortfall on the MUCF. This agency lends money to Municipalities for capital projects at rates better than those available to private developers, so it is really the cheapest money available. $43 Million will come from the Casino DAC money (more on this later). Then “up to” $33Million will be borrowed from Capital Reserves budget (money used to upgrade pipes in the ground and potholes in streets). The “up to” $15 Million being borrowed up to cover the shortfall while waiting for DAC money to arrive is presumably part of the $43 Million, so we won’t count that again. Nor will we count the $7 Million pickle on top, because it won’t be needed until we have leases, so it will no doubt come from those leases.

Apparently, the DAC money set aside for the MUCF was not $43 Million, it was $35 Million. The extra $8 Million may be directed from other DAC-funded projects (the so-called “funding flexibility” being sought by the City). The remaining funds are $10.3 Million for the alleged pedestrian crossing between the Quayside and Port Royal, and $4 Million for dock improvements at the quayside, the rest of the DAC money already spent on those great parks and boardwalks in Queensborough, an the new community centre in Queensborough. The City is apparently looking to take $8 million of the remaining money and use it for the MUCF, at least temporarily.

I was really worried when I read this. The pedestrian link to Queensborough is a fundamental missing link in the City’s sustainable transportation infrastructure. To think that the City will cancel that project just as our new Master Transportation Plan is coming together shocked me. I vocalized my concern enough that one City Councillor took me aside at the MTP open house last Thursday and assured me that the bridge was still going to happen, there was no plan to cancel it. I have no reason to think he would lie to me, so I am taking him at his word. I assume (though could not confirm) that this $8 Million could be used to fill short-term funding gaps, if none of those “up to”s above are available, and are needed. The money is there to provide flexibility, and to give the City one more option to potentially reduce the costs of financing, as any prudent business would do. I will be the first at the gates of City Hall with a pitchfork if that bridge gets cancelled. I give them until 2015.

After borrowing somewhere between $44 Million (the $33M for the tower + $11M for the Parking) and $51 Million (if we include the $7M improvement money), the City will either own a revenue-regenerating asset, or will sell off the revenue-generating part of the building to recover their costs. We know the demand for the office space exists. Class A office space is valued north of $30/sqft per annum, and is going up. This building will generate parking and other tax revenue. It could bring 500+ more workers into Downtown New Westminster every day (or keep the young professionals moving to New Westminster working n New Westminster).

Watching council discuss the MUCF decision on the video-feed meetings last week, and hearing what the other options were, I can see where they are coming from. This project is too important to the future of the downtown to let it fall off. It is important to note that the Municipality can borrow the money at rates and with terms that no Developer can get, so the risk is lower for the City than it would be for a private developer. Also, some of the on-line discussion around this has not seemed very factual- the City is not “spending $60 Million of taxpayers money” as some commenter suggested, they are making a strategic investment that will no doubt bring some returns, if those returns exceed the investment (and we have many reasons to think it will), then the Taxpayers will make money (well, not really, taxpayers never make money, we just pay less money, I guess). This investment will also result in more taxpayers, which is what economic development is all about.

I find it disingenuous for people to complain that Government should be run “more like a business”, then freak out when a Government does the one thing that all businesses must do to survive: take a strategic risk. I hope that Council have received the business advice that tells them this risk is good. I also hope the real beneficiaries of this strategic risk – the retail businesses of Downtown New Westminster and the developers planning new buildings down there – will step up and throw their support behind this. I’m bully about the future of New Westminster, it is clear that Mayor and Council are, and it seems many developers are. I am cautiously optimistic we can make this pay off, and the result will be better than the current hole in the ground

One potential downside I can see is that this investment could potentially make it harder for the City to make other important investments in the next few years. Upgrading or fixing the Canada Games Pool, securing the Kyoto Block as public space, Queens Park capital improvements, connecting the Pier Park to amenity space east and west, refurbishing the old Gas Works site, etc. However, the City is in a tough situation. I’m not sure why they dug a hole downtown until they had an iron-clad contract with whomever was going to fill it, but again, I am so bereft of details that it is hard to understand how this situation arose. The MUCF was a good idea last month, and it is still a good idea today.

The one person I would love to have a coffee with over this is Bart Slotman, but I haven’t seen him around.

I too am cautiously optimistic. And in my view even a hole in the ground is better than what was there before.