We had another budget workshop last week, and I’m sorry I’m so late getting to writing about it, but the usual level of chaos in my life was amped up a bit by too many meetings this week, including a chance to Fan-Boy on the two best “City beat” reporters in BC.

In the November 23rd workshop, Council took a first review of the Operating Budget. This is the money we spend day to day in the operations of the City. Not the buildings and equipment we use, but the staff in those buildings and the fuel for that equipment. And this is the budget that relates directly to the tax rate calculation for next year. One of the complicating factors in how we assess “the budget” is that we really have more than one. I have already talked about the Capital Budget and I already talked about Utilities, so I am going to ignore both of those as much as I can and talk just about Operations here.

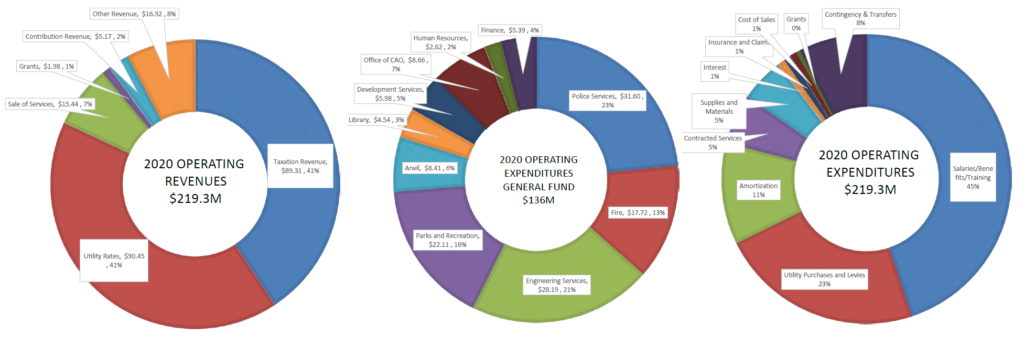

The math form the 2020 budget looks like this:

So about 70% of our revenue in the general Operations Fund (aside from utility rates) comes from your property taxes. We also make money selling services (like concession stand hot dogs, swimming fees, and parking), a bit from senior government grants, more from “contributions” (casino money, etc.), and “Other” (which includes license fees, permitting fees, fines, interest on savings, an such). You can see the departmental breakdown of where the money is spent (in this case, shown without utility spending), and the breakdown of what we spend the money on (about 50% paying people, 35% buying stuff, 15% on financial stuff like amortization and interest).

2020 was (no surprise) a challenging year. Revenues fell short by almost $4 Million in sales of services (recreation fees, Anvil events, parking), an equal amount in lost Casino revenue, and about $1 million in other revenues. We also had significant operation savings, especially in staff costs related to not having to hire auxiliary staff to provide those suspended services like recreation classes, reduced training costs and suspensions of hiring at the peak of the Pandemic. We also had some unexpected costs related to the Pier Park fire and operating the Emergency Operations Centre for Pandemic response. The emergency Pandemic support money provided by the Province and Federal Government definitely helped and it looks like we are going to be in ok financial shape at the end of the year. We got through.

That said, we are not home and dry. To quote Ford Prefect, “We could not even be said to be home and vigorously toweling ourselves off.” The Pandemic is still here, and is still impacting our function and our finances. This makes modelling for 2021 difficult. We don’t know when revenues will come back, and certainly expenses are going to come back faster. We have to make some assumptions, and have to be conservative about those to keep ourselves from getting into financial trouble. We are assuming that $5 million of casino revenues are not coming back next year, that recreation programs and other sales of service will still be curtailed to the tune of $1.8M, and that we will be spending $550,000 on COVID response programs.

Once we set that as a baseline, we can project the “fixed” cost increases in the City related to already negotiated annual salary increases and inflation, which will be about $2.1 Million above 2020, and that our Capital Program as currently envisioned (mostly, that we break ground on the CGP replacement) will cause about $1.6 Million in debt financing costs. Staff have identified about $1 Million in operational efficiencies or savings, and have identified $3 Million in potential budget “enhancements” (new stuff we could do, or new staff we may need to meet the strategic goals set out be Council). Put that together, you end up with about a 6.3% tax increase in 2021. Yes, Council asked for lot of stuff over the last year.

If we don’t want the tax increase to be that big, we need to cut some stuff from the budget, which is what most of the conversation from this point forward will be about. We spent some of the workshop discussion various “enhancements” and hearing reports from staff about their departmental operations and pressures that would either support or not those “enhancements”. When we get back together on December 7th, staff will have hopefully worked through those comments and come back with a draft budget that we can then start adjusting.

So all that to say, there is a *lot* of information in the public reports about the budget you can read here, and lots of it was related in the public meeting the video of which you can see here, and we have some work to do.