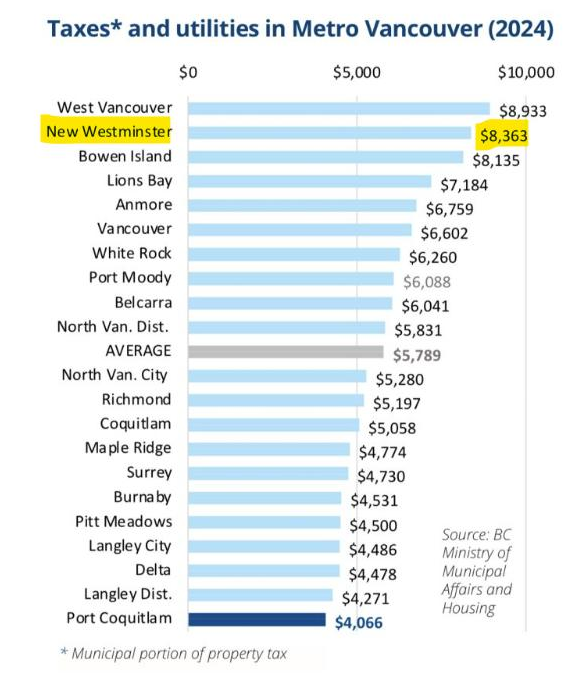

It’s been a while since I saw this kind of comparison, but it is circulating on local social media again, seeming to point back at some politicking by a certain group who obviously know the truth, but have little interest in honest discussion, preferring to ask leading questions instead of seeking seeking answers when they have just as much access to all of the data as I do. Here is the graphic:

There are two problems with this comparison, which was generated by the City of Port Coquitlam for their own political reasons.

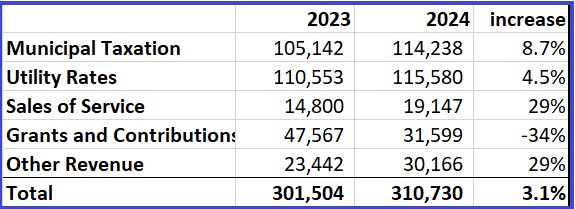

One is that the numbers include electrical utility charges collected by New Westminster because we own our utility, and does not include household or business electrical utility costs for any other municipality (because they buy their power from BC Hydro). I call this zombie data because every time this bad comparison rears its head I knock it back with the facts, but it gets back up and starts grunting again. Like back in 2018 when the Fraser Institute did the same lazy comparison, somehow claiming we had the second highest taxes while the very same report showed New Westminster having the 12th highest taxes of 17 municipalities in the Lower Mainland.

Then the story resurfaced three years later with another FI news release where they compared revenue and spending between cities. The fun part this time was digging into the data that the FI used and (after removing electrical revenues and spending) seeing that New West’s spending (the services we deliver to community) are higher than the regional average, but our revenue (the money residents and businesses pay for those services) was lower than the regional average. You would think the folks at FI would appreciate New West delivering more for lower costs. The FI also had a chart showing New Westminster spending increases for the decade were among the lowest the region. So thats good news?

Follow those links to see the data, with links to the sources! As we all learned in math class: it is important to show your work!

The second problem with the graphic above is that the chart is the “tax on a representative house”, not tax on the average or median household. That is the average single family detached house, which in New Westminster is estimated (in 2025) to be about $1.6M. But in New Westminster, we have one of the highest proportions of renter households (45%) in the region, and the vast majority of New Westminster households are in multi-family. This means the average residence is closer to a $700,000 condo that would pay half this amount of tax and much less in utilities. Taxes on a “representative house” does not reflect the typical tax or utility bill here.

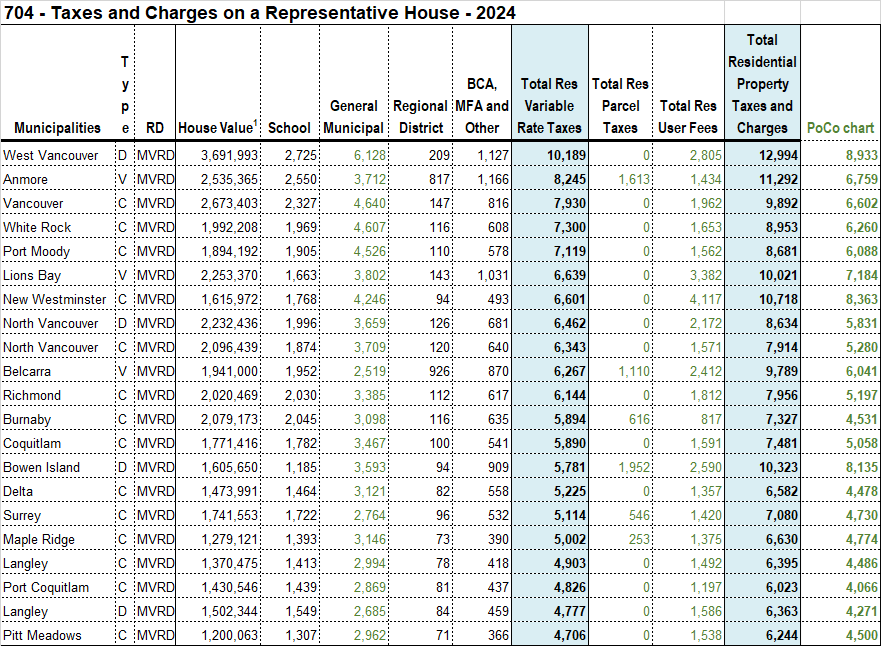

The numbers on this chart come from some massaging of Provincial government stats reported out as “Schedule 704” which you can read yourself here. If you don’t want to click through an download the spereadsheet, I have extracted the part of the table that is only Metro Vancouver municipalities (as our tax regime is different here than the rest of the province, due to TransLink and the fact we don’t pay Hospital tax as they do elsewhere). I also used the 2004 table, not the more recent 2025 one, because the graphic above uses this 2024 data:

I highlighted in green the numbers that PoCo used in that chart above, and added a column summing these up to show how PoCo came to their conclusion. Naturally, they chose the comparison most generous for their purposes, not including all the taxes and fees people pay, after all, PoCo is not the lowest taxed city even in this flawed comparison.

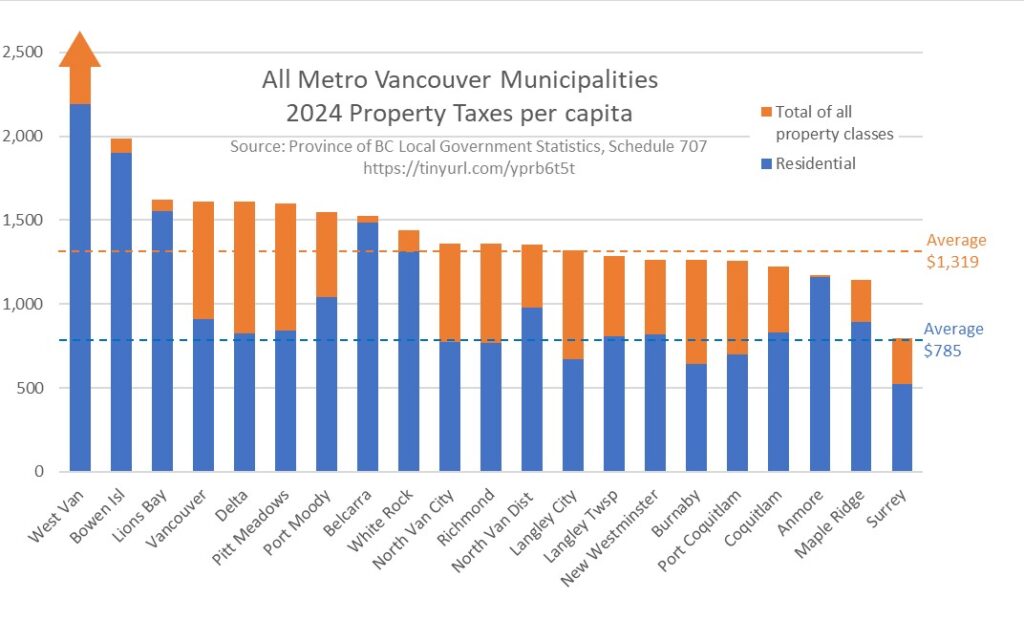

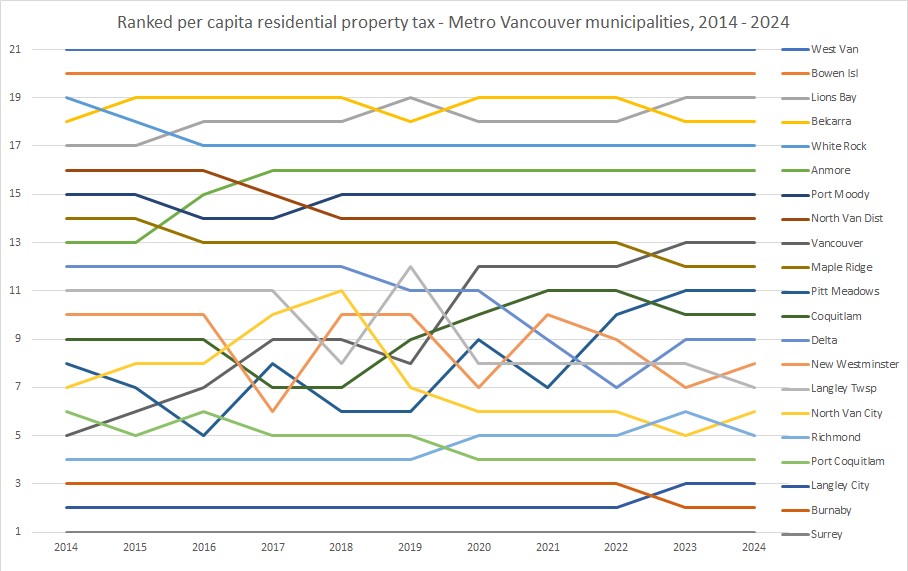

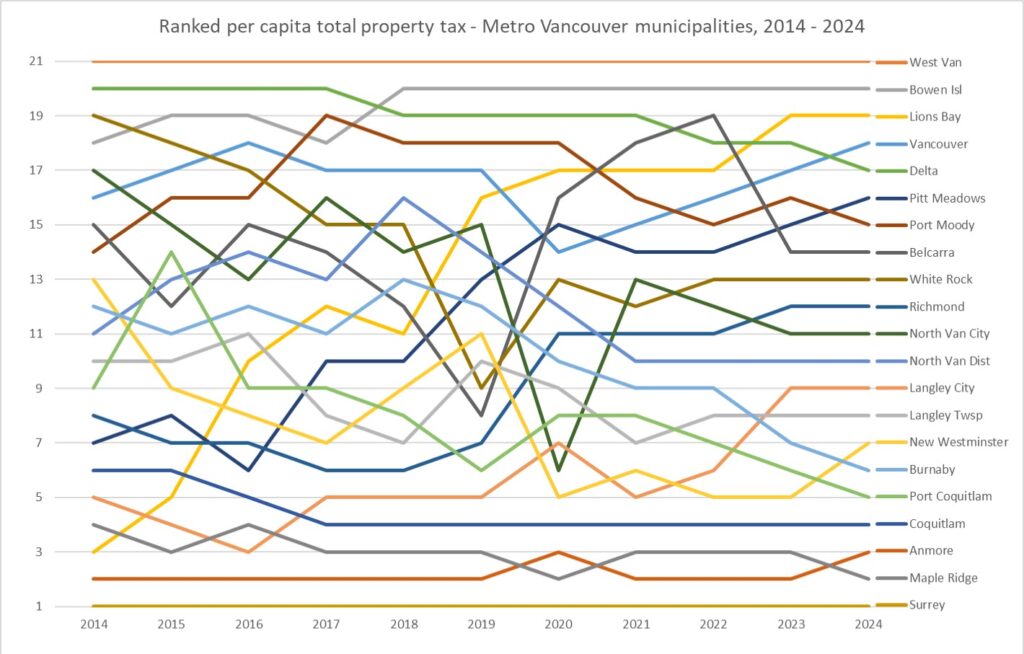

In my mind (and you may disagree) the more fair comparison is the taxes per capita, because ultimately people pay taxes not houses, and people receive the services that the City pays for with its taxes. I explained this a bit more here (again, older numbers, but comparison still fits), with an update with 2024 numbers displayed in a different way here.

In short, and I know there is a lot here (remember Brandolini’s Law), most apples-to-apples comparisons show New West is about average of the region for property taxes people pay both per capita and per household, and over the last few years, our annual increases have been slightly below the regional trend. Spread the news.

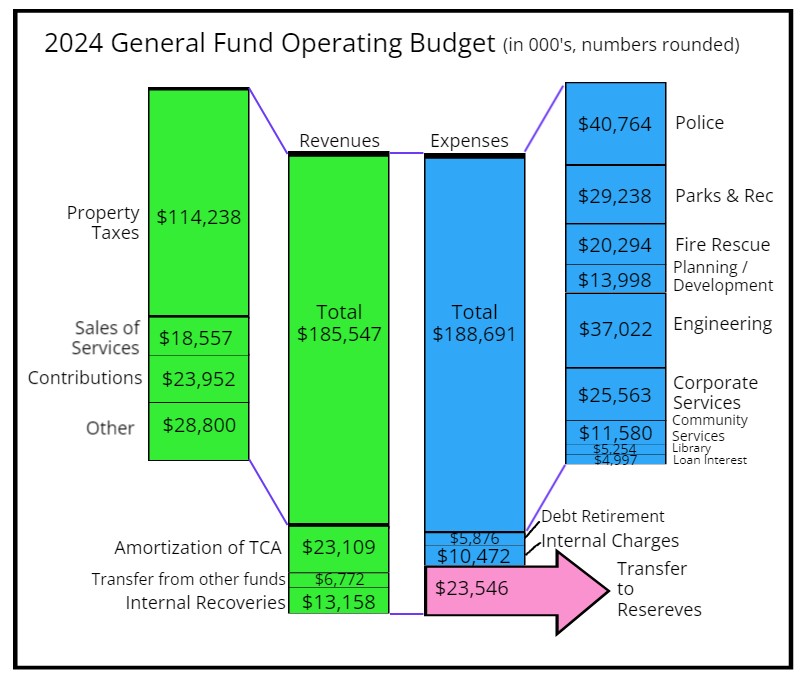

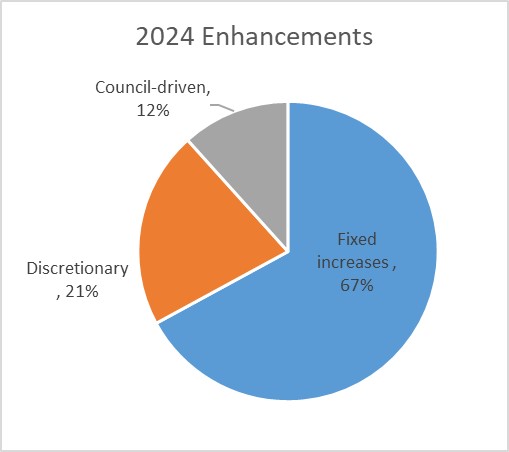

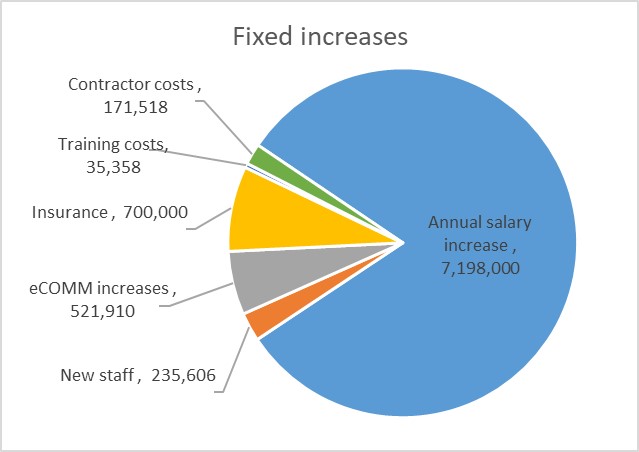

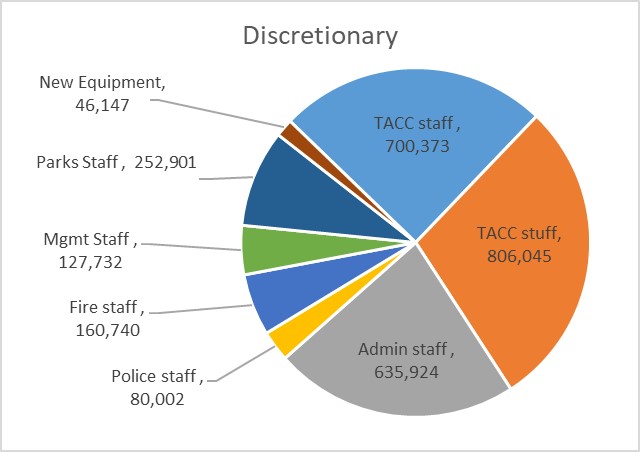

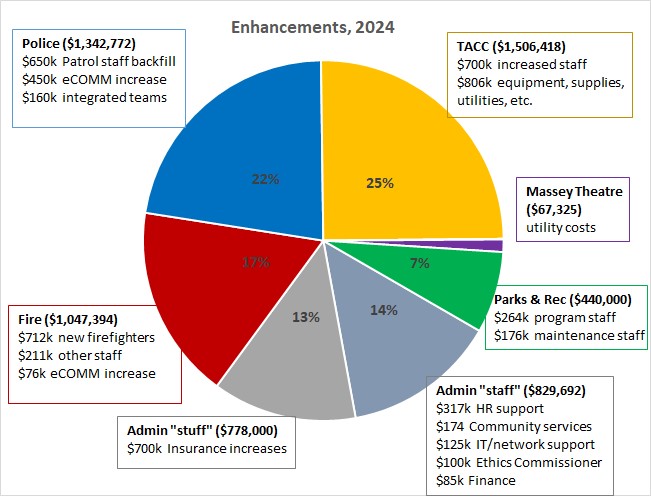

First off, two-thirds of this increase is fixed cost increases, increased costs to deliver the same services we provided in the previous year and things that we are legally or contractually obligated to pay for. About 21% are “discretionary” increases recommended by staff, things we are not legally committed to, but are required to keep service commitments we made to the community. The last 12% are things Council has directed to staff that we want to see happen in the upcoming year. Each of those three can be broken down further:

First off, two-thirds of this increase is fixed cost increases, increased costs to deliver the same services we provided in the previous year and things that we are legally or contractually obligated to pay for. About 21% are “discretionary” increases recommended by staff, things we are not legally committed to, but are required to keep service commitments we made to the community. The last 12% are things Council has directed to staff that we want to see happen in the upcoming year. Each of those three can be broken down further:

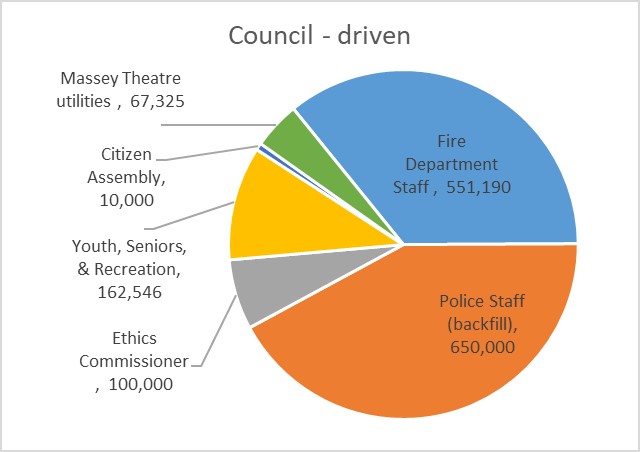

The Council-driven increases are things Council directed to be added to the base budget, mostly in that December workshop. Most of this is in Public Safety, with increased Fire Department staff and new staff for front-line Police to address backfill (that is, we are not increasing the compliment of sworn officers, we are hiring more to provide better coverage for vacancies, sick and parental leave, etc.). Our new Code of Conduct requires budget for an Ethics commissioner, we are augmenting some staff positions to support youth and seniors programming, and the Massey Theatre utility costs are higher than anticipated.

The Council-driven increases are things Council directed to be added to the base budget, mostly in that December workshop. Most of this is in Public Safety, with increased Fire Department staff and new staff for front-line Police to address backfill (that is, we are not increasing the compliment of sworn officers, we are hiring more to provide better coverage for vacancies, sick and parental leave, etc.). Our new Code of Conduct requires budget for an Ethics commissioner, we are augmenting some staff positions to support youth and seniors programming, and the Massey Theatre utility costs are higher than anticipated.

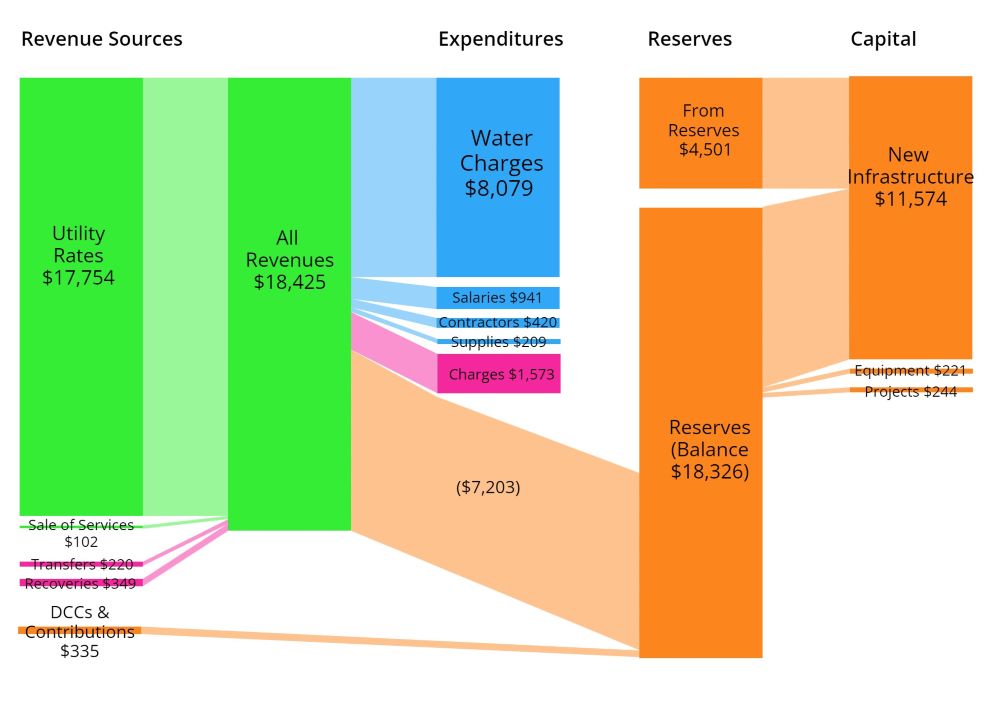

Again, our main source of revenue is utility rates, and the DCC/contribution part is much smaller in water this year. That has mostly to do with the timing of capital projects and our success at getting senior government grants for sewer work more than water work. Of the $18.5 million we take in, about 44% goes directly to Metro Vancouver to pay for the water. We spend less than 10% of our budget on operations, though with internal charges (the money other city departments charge the water utility for services), this cost is a bit higher than in sewers.

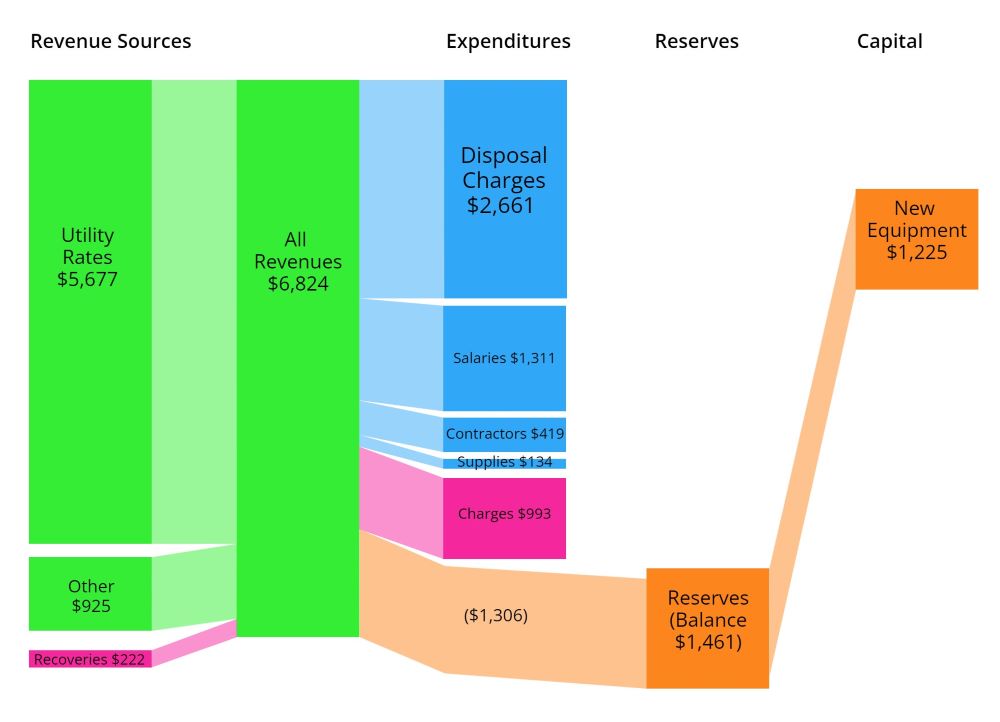

Again, our main source of revenue is utility rates, and the DCC/contribution part is much smaller in water this year. That has mostly to do with the timing of capital projects and our success at getting senior government grants for sewer work more than water work. Of the $18.5 million we take in, about 44% goes directly to Metro Vancouver to pay for the water. We spend less than 10% of our budget on operations, though with internal charges (the money other city departments charge the water utility for services), this cost is a bit higher than in sewers. Garbage and recycling are bit different than the other utilities, as the level of service provided to different parts of the community (house vs. strata, home vs. business, etc.) varies quite a bit, and although disposal charges handed down (mostly from Metro Vancouver) for taking in our waste still eat up almost 40% of all of our revenues, there is a much larger operational cost to solid waste. We need staff to drive those trucks and fuel for the trucks, because you can’t put your trash in a pipeline.

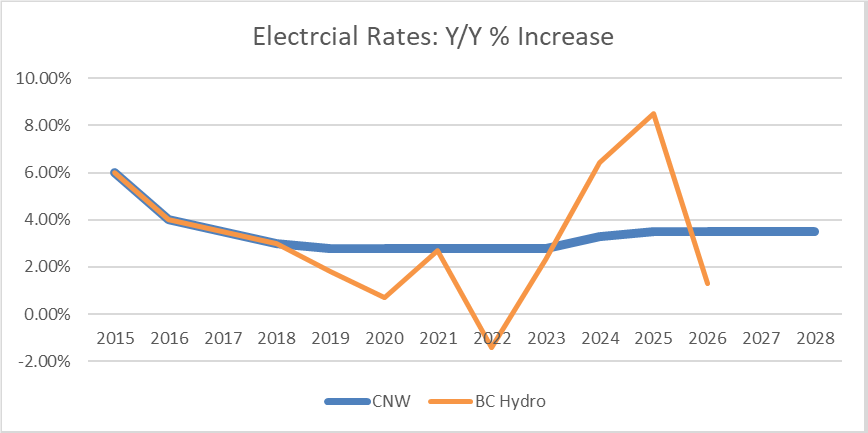

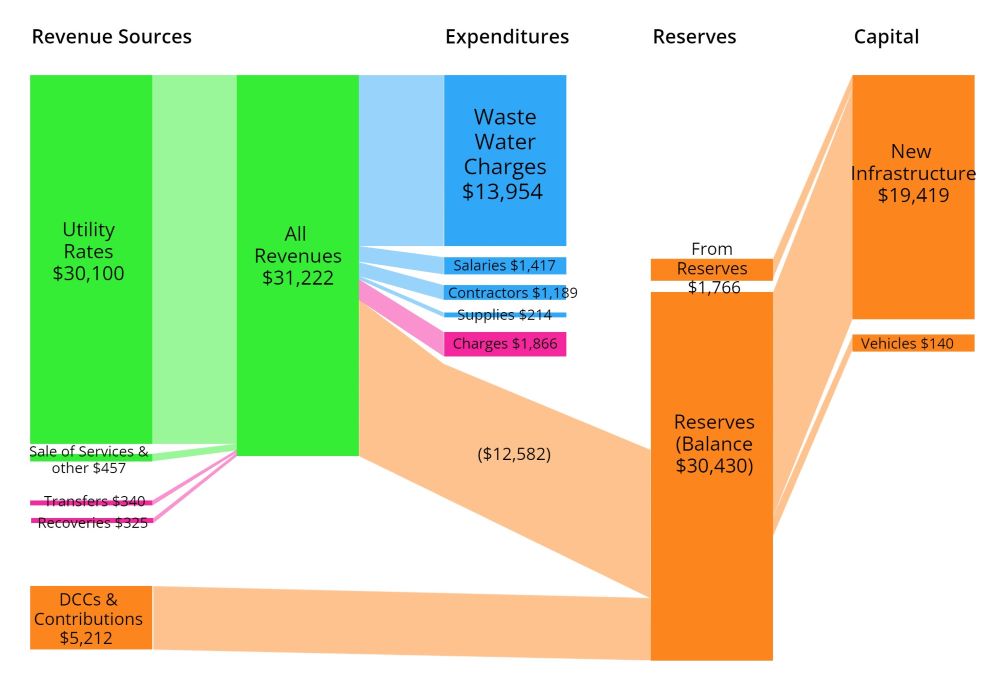

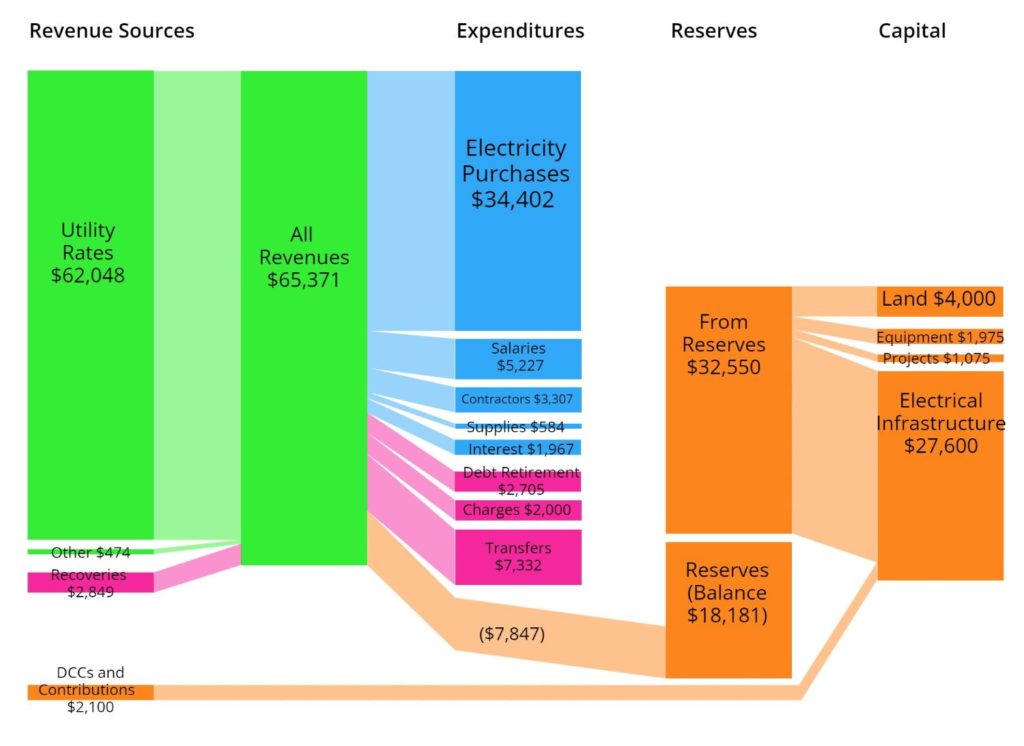

Garbage and recycling are bit different than the other utilities, as the level of service provided to different parts of the community (house vs. strata, home vs. business, etc.) varies quite a bit, and although disposal charges handed down (mostly from Metro Vancouver) for taking in our waste still eat up almost 40% of all of our revenues, there is a much larger operational cost to solid waste. We need staff to drive those trucks and fuel for the trucks, because you can’t put your trash in a pipeline. Our Electrical Utility has a few unique aspects, but it functions like the other utilities we have. The electricity we purchase at wholesale from BC Hydro costs us just over half of our overall revenues, and the cost of day-to-day running of the utility costs about another 17% (or a little over $11 million). This leaves us with about a third of income that goes into our Capital Reserves or directly to the City as transfers. The transfer number here is large because it includes the dividend the City takes every year from electrical utility operational surplus and puts it in the general operational fund. This amounts to about $6 million that the City uses to offset property taxes in providing services that we otherwise wouldn’t be able to deliver.

Our Electrical Utility has a few unique aspects, but it functions like the other utilities we have. The electricity we purchase at wholesale from BC Hydro costs us just over half of our overall revenues, and the cost of day-to-day running of the utility costs about another 17% (or a little over $11 million). This leaves us with about a third of income that goes into our Capital Reserves or directly to the City as transfers. The transfer number here is large because it includes the dividend the City takes every year from electrical utility operational surplus and puts it in the general operational fund. This amounts to about $6 million that the City uses to offset property taxes in providing services that we otherwise wouldn’t be able to deliver.