The 2024-2028 5 year Financial Plan was formally adopted by Council on March 11. This is the last step of the annual budget process for Council, though Staff have a lot of work to do yet in submitting documents to the province and getting those tax notices out.

I have written about different parts of the budget here: Operations, Capital, and Utilities. But the news story on the budget usually get boiled down to one number, the annual tax increase. This year’s number is higher than we are used to (though not anything near a “record” increase, as offered a few times by those who dabble in misinformation) at 7.7%. This puts us firmly in the middle of regional tax increases announced so far, which range from 4.5% in Burnaby to 10% in Langley, though the final number in Surrey has yet to be announced, but will likely exceed Langley’s.

The reasons for these higher increases everywhere are essentially the same – inflation and wage increases related to new collective agreements across the region with CUPE, Police and Fire unions, themselves being pressured upward to match regional inflation and housing costs. The biggest differences within the region are related to varying levels of service enhancements, from Surrey needing to invest in a new Police service to New Westminster needing to staff up a new $114M recreation centre. So this post I’m going to break down the increase in New West, hopefully answering a bit of what are you buying for your extra $300 this year (if you own a $1.6M house), or extra $125 if you live in the “typical” $640,000 apartment.

Again, the best way for you to dig into these numbers, if you are so inclined is to go to the January 22 Council workshop where we discussed this after giving staff some direction during the December 11 workshop, where staff proposed a 6.8% tax increase, and Council brought requests for enhancements that pushed this up by almost 1%.

“Enhancements” is one of those jargon words we use in municipal budgeting, and to talk about it is to talk about how staff approach annual budgeting. The first step is to look at everything we did last year, and hang a baseline on that. They then go through and find “efficiencies” (things we don’t need to do anymore, or cost us less to do now than they used to), and inflation/salary increases and calculate a new baseline based on those. They then look at the many, many things that Council or the Public has asked them to do beyond what they did last year. These are “enhancements” – things we didn’t do last year, but the community has asked us to offer or we need to do now because of functional or legislative changes. Staff determine what they can practically deliver, and propose what enhancements Council might consider for the coming year. Depending on the city, these are offered as service level measures, or a job positions for the people expected to deliver the job. In New West we generally do the latter, and there are strengths and weaknesses of each approach, but I’ve already gone too far down this rabbit hole.

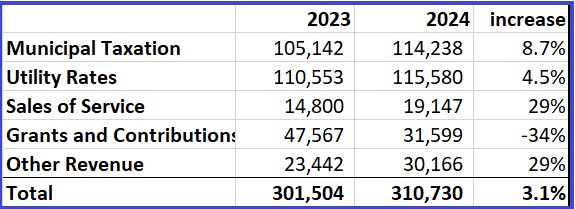

A reasonable question I hear often is “with all these new buildings, how come my taxes still go up?” If we compare the revenue side of the 2024 Operational Budget to 2023 (the numbers are in thousands):

we see that we are planning to collect 8.7% more tax revenue than last year, or an extra $9 million. The 7.7% tax increase provides about 89%, or $8 million of this, while little more than 11% or $1 million in new tax revenue will come from charging taxes to property that didn’t exist last year – directly from growth. But remember a large portion of those other revenue sources are from things new growth pays for: building permit revenue, amenity charges and such. Look at the Sale of Services line, which is anticipated to go up by $4.4 million. Part of this is the opening of TACC, but also through increased service delivery across the City we draw more revenue from more people.

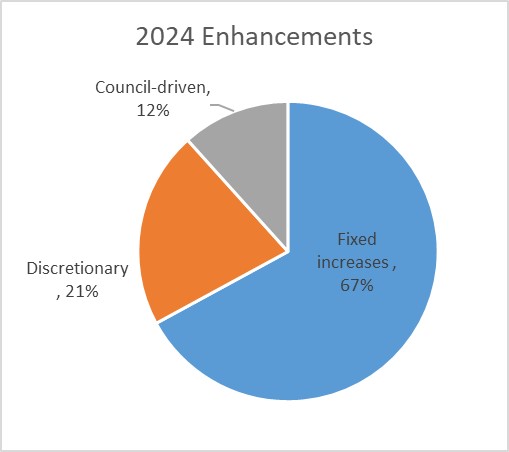

These two lines combine for ~$13 million in increased revenue. This aligns (not perfectly, but there are complicated reasons for this) with the “Proposed to Fund from Tax and Other Revenue” column at the end of the table that provides the long list of enhancements proposed for 2024 that you can see starting on page 53 of this report. This table (with a bunch of caveats) is the detailed answer to “what you are buying with the 2024 tax (and sale of service) increase?” So I am going to break the $13 million from that table down to categories to give an order-of-magnitude answer. There are lots of ways to break these down, and much overlap between each, so here come the pies. First off, two-thirds of this increase is fixed cost increases, increased costs to deliver the same services we provided in the previous year and things that we are legally or contractually obligated to pay for. About 21% are “discretionary” increases recommended by staff, things we are not legally committed to, but are required to keep service commitments we made to the community. The last 12% are things Council has directed to staff that we want to see happen in the upcoming year. Each of those three can be broken down further:

First off, two-thirds of this increase is fixed cost increases, increased costs to deliver the same services we provided in the previous year and things that we are legally or contractually obligated to pay for. About 21% are “discretionary” increases recommended by staff, things we are not legally committed to, but are required to keep service commitments we made to the community. The last 12% are things Council has directed to staff that we want to see happen in the upcoming year. Each of those three can be broken down further:

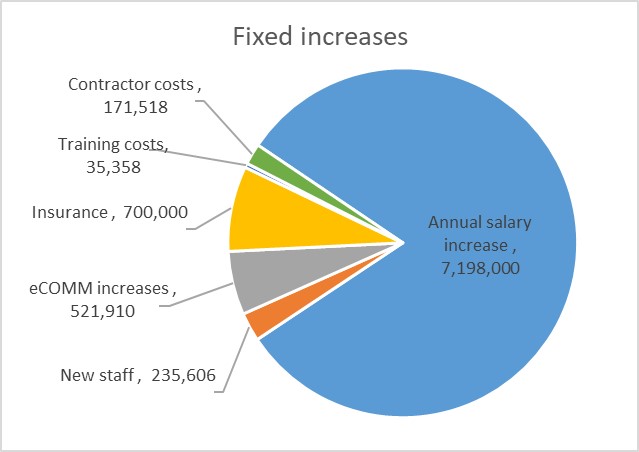

On the fixed increases, the largest part of the pie is $7.2 million in annual salary increases and increases related to the new collective agreements signed with our CUPE, Fire, and Police unions. This big piece of the biggest pie represents more than half the cost increase this year. The “new staff” section here is mostly new Emergency Management Office and Fire Prevention staff required due to new provincial regulations. The biggest fixed cost increases outside of this are an extra half a million for eCOMM (the service that provides 911 service and emergency dispatch for the region) and a big increase in insurance rates (something many in the community will recognize in their own lives).

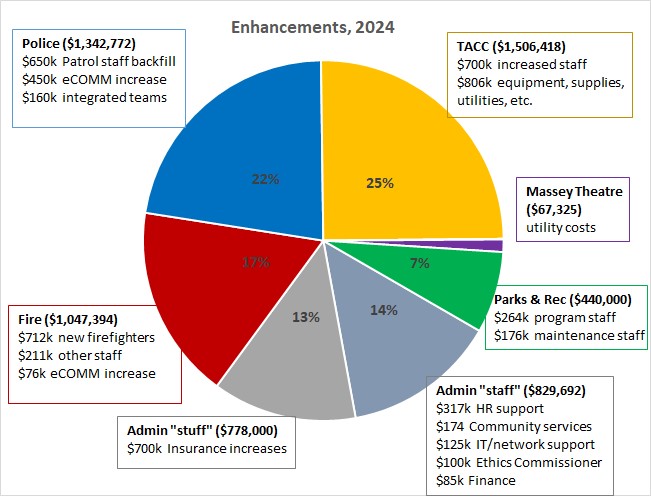

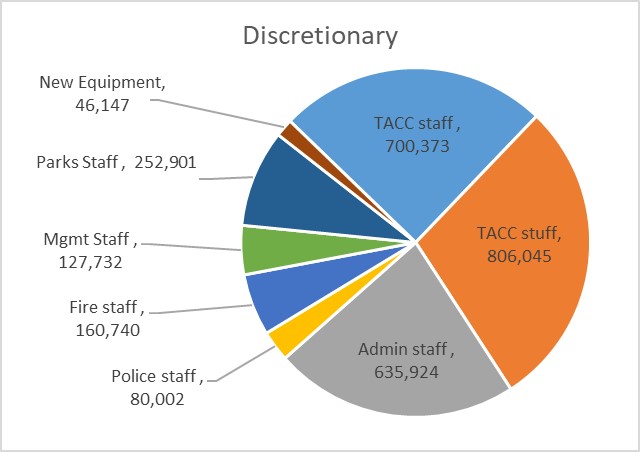

The “discretionary” increases are dominated by the opening of təməsew̓txʷ Aquatic and Community Centre, which speaks a lot about how discretionary much of this actually is. These are the costs (above and beyond what it cost to run the Canada Games Pool and Centennial Community Centre) related to opening a much larger building with many more programs. I divided it up here into annual increased staff cost (about a dozen new people between regular and auxiliary) and stuff cost (increased supply, utility, equipment, and such cost). In theory, we could open the new pool without staffing and equipping it up fully, but that is probably not a good idea. There are also two new firefighters, a new HR staff position in Police, some increased Parks staff to run programs and care for trees, and some Admin folks in HR, IT, Finance, along with a new Director position to support our re-organization of Community Services into its own department.

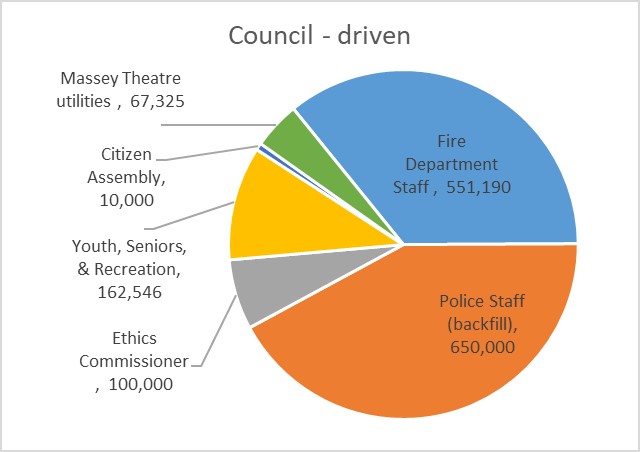

The Council-driven increases are things Council directed to be added to the base budget, mostly in that December workshop. Most of this is in Public Safety, with increased Fire Department staff and new staff for front-line Police to address backfill (that is, we are not increasing the compliment of sworn officers, we are hiring more to provide better coverage for vacancies, sick and parental leave, etc.). Our new Code of Conduct requires budget for an Ethics commissioner, we are augmenting some staff positions to support youth and seniors programming, and the Massey Theatre utility costs are higher than anticipated.

The Council-driven increases are things Council directed to be added to the base budget, mostly in that December workshop. Most of this is in Public Safety, with increased Fire Department staff and new staff for front-line Police to address backfill (that is, we are not increasing the compliment of sworn officers, we are hiring more to provide better coverage for vacancies, sick and parental leave, etc.). Our new Code of Conduct requires budget for an Ethics commissioner, we are augmenting some staff positions to support youth and seniors programming, and the Massey Theatre utility costs are higher than anticipated.

So overall, 54% of the increase this year is related directly to salary inflation, which was high last year (~5%) because new collective agreements included backpay to the expiration of the previous agreement a year before. The other 46% of the increase this year can be broken down like this, which is probably the simplest answer to that first question “What did I but with my tax increase this year?” if you don’t want to read that multi-page spreadsheet I linked to above.