It’s Budget time. The City is currently approving its annual budget, which is more accurately and bureaucratically called the 2024-2028 Five Year Financial Plan Bylaw. There is a lot that goes into a budget like this, and a lot to look at, so I’m going to spend a bit of time writing about it, and hopefully opening up the details so you can understand what you are buying when you write those Property Tax and utilities cheques. I’m going to start with breaking down the various part of the budget.

To understand how we budget, you need to understand the difference between the Operational part of the budget, and the Capital part. You also need to understand the difference between General funds and Utility funds.

The Operational part is the day-to-day running of the city and the programs we offer. On the expense side this is mostly paying staff to do the work, but also includes the cost of consumables we go through as part of operations, like gas we buy to run the police cars, paper we buy to feed the photocopy machines, and things like insurance and bank charges. The money going into this part of the budget mostly comes from property taxes, but also includes grants from senior government, sales of services, and other revenue sources. This is the part of the budget people most people pay most attention to, because this is the one that results in that all-encompassing narrative around the “annual percentage tax increase”.

The Capital part is the money we are investing in the things we need to run a city: buildings, roads, sewers and pipes, a vehicle fleet and computers. We have a five-year capital plan that we periodically adjust so staff can plan out purchases and schedule construction. Every year, we take surplus money out of our operational funds and transfer it to reserves that are then, in turn, applied to pay for the things in our Capital Plan. We can also (within some regulated limits), borrow money to pay for these capital investments.

The General fund is how we budget for the general operation of City services that are funded mostly through property taxes. This is how we pay for parks and recreation services, Police and Fire services, running City Hall and the Library, bylaws operations, planning and much of our engineering services.

Separate from this are Utility funds. In New Westminster we have four separate Utilities: water, sewers and drainage, solid waste, and electrical. All of these rely on utility charges for their revenue, and are completely separate from property taxes. We spend utility money on the utility, and it isn’t mixed with “general revenue”, with two exceptions. First, there are transfers from the Utility funds to the General fund related to staff working on utility files (“internal recoveries”), and transfers the other way, because the City has to pay for its own use of utilities (“internal charges”) out of the general fund. The second exception is the annual dividend paid to the general fund from the Electrical Utility.

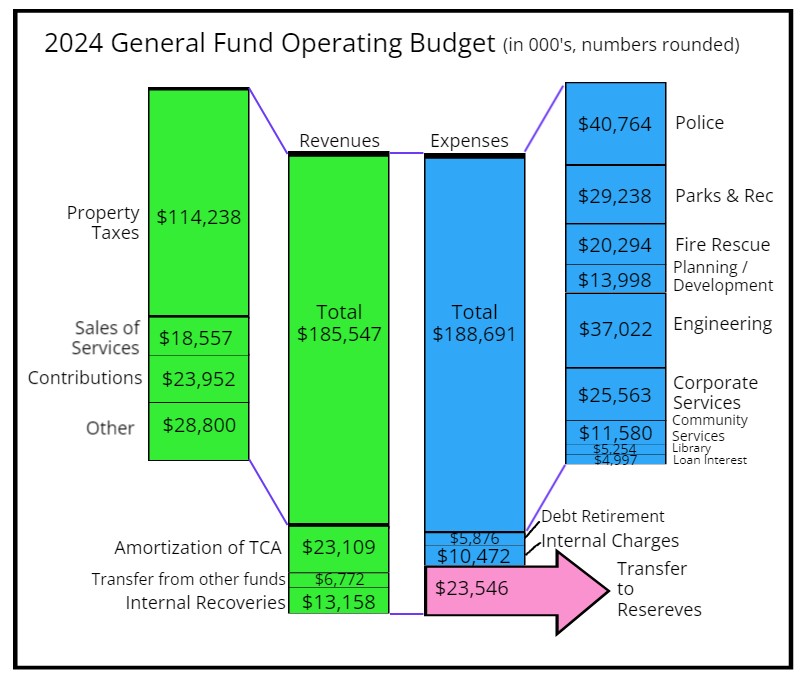

Here is how the General Operating fund breaks down for 2024:

On the left is “money in”, on the right is “money out”. The things “below the line” like Amortization or our Tangible Capital Assets and Internal Charges (the money our utilities charge to our General Fund account for utility services the city receives) are separated out because they aren’t really money in-out of the City, but money moving between accounts or accounting categories in the City. The biggest of these is the $23.5 million surplus which is transferred to reserves so it can pay for the Capital part of the budget, which I’ll write about later.

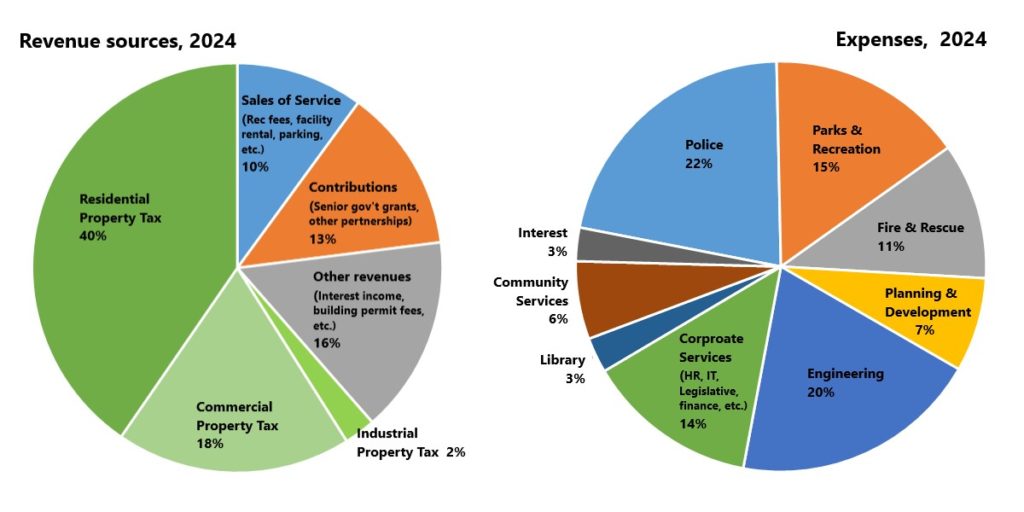

Some people like pie, so here are two pie diagrams: where our revenue comes from, where our expenses are allocated:

This diagram shows how some of the narratives we would like to use around our budget are not exactly accurate. Ideas like “15% of your tax dollars go to Parks” belie the idea that your residential property taxes are only 40% of our revenue. And as all of these expense items are total spending of a department, they ignore that many of these departments recover a lot of revenue through their operations through fees or other sources. The Police category is a specifically difficult item, because the NWPD pay for a lot of things (IT support, Finance staff, fleet operations) out of their budget that other departments like Planning don’t – those are captured under Corporate Services for every department that is “in City Hall”. Still , if you want to know how money in the City is spent, the pies are a start, as long as you are comfortable with all of the caveats.

Next post, I’ll write about the Utilities budgets.