The Monday meeting was an eventful one, and I have already written some initial thoughts about that, and have more thinking and work to do. But before that all, we did get through our full Agenda, which started with us moving the following items on Consent:

Development Cost Charges Expenditure Bylaw No. 8437, 2024

We collect Development Cost Charges from developers to pay for infrastructure related to growth. To spend those DCC funds, we need authorization from Council. This Bylaw authorizes spending (numbers here approximate, itemized to the dollar in the report) $380,000 from our Drainage DCC and $1.2 million from our Sanitary Sewer DCC for sewer separation and modelling work, $145,000 from our Transportation DCC for pedestrian safety improvements, applying $450,000 from our Park Acquisition DCC towards the Pier Park loan, and $850,000 from the Water DCC for water main replacement.

Heritage Revitalization Agreement and Heritage Designation: 203 Pembina Street – Bylaws for First and Second Readings

There is a property in Queensborough where the owner wants to build townhouses consistent with the OCP, and they require a rezoning to do so. As the City and the community expressed concern about losing a prominent tree on the site, the owner agreed to a path where an HRA is offered instead of a typical rezoning. This provides permanent protection to the tree. This has not happened before in New West, but seems a creative way to balance development and tree preservation. The HRA will go to a Public Hearing, so I will hold my comments until then to respect the process.

Zoning Amendment Bylaw No. 8436 (Miscellaneous Zoning Bylaw Amendments) for Consideration

This is a bit of an omnibus bylaw to update our zoning bylaw in various small ways, correcting the inconsistencies, redundancies, language changes, and administrative errors that accumulate in such a complex Bylaw document. There are also a few minor changes to reflect best practice that are not properly codified in our existing Bylaw.

Construction Noise Bylaw Exemption Request: Metro Vancouver Valve Replacements (660 East Columbia Street)

A required valve replacement in the Sapperton Water Main that they are coinciding with some TransLink work for a bunch of good efficiency and operational reasons, and it is going to require some work outside of regular construction hours, which received Council approval.

The following items were Removed from consent for discussion:

Construction Noise Bylaw Exemption Request: 660 Quayside Drive)

The construction of the Bosa development on the waterfront is nearing completion, and they need to remove the crane, which requires Saturday work outside of regular construction hours. Council granted a Noise Bylaw exemption to permit this.

Budget 2024: Draft 2024 – 2028 Five Year Financial Plan

Our budget is approved by Council in the form of a Five Year Financial Plan, with a 5-year Capital Budget that sits alongside it. We have had a half dozen open workshops on this, over 9 hours of discussion and deliberation, including going back and forth with staff on the line items in the plan and the strategy for paying for all of the items in the plan. There were some significant changes made through the last couple of meetings, and asked staff to take all of that away and draft it into a Bylaw we can vote on (as per Section 165 of the Community Charter).

Our Utility rates are going up between 3.3% and 12.0%, driven primarily by the increased cost of service being passed down to us by Metro Vancouver (for water, sewer, and solid waste services), and our long-term asset management plan that is pushing capital investment to upgrade our utility networks and maintain sustainable reserve levels for the future of the utilizes.

Our five-year Capital Plan is pegged at $208.8 million for general City services (e.g. those funded by taxes) and another $272.9 Million in utility investments for a total of $481.7 million. As we are wrapping up a couple of large capital projects, a good portion of our 2024 capital budget will be funded by reserves set up for this purpose, meaning those reserves will be going down, from $256.8 million to $177.9 million. The 5-year plan sees these building back up to $238 million by 2028 as part of our long-term commitment to a sustainable reserves policy aligned with best practices.

Our “General Fund” operating budget has reached $189 million, which requires a 7.7% tax increase to support. More than half of this reflects inflationary increases and new labour contracts secured in 2023. And I wil write up a follow-up piece on the things that informed our budget decisions.

After reading a few Bylaws (none for Adoption at this time, we moved on to Motions from Council:

Establishing delegation to visit Port Coquitlam to review best practices for limiting tax increases while increasing services

Councillor Minhas

Whereas the City of Port Coquitlam with a population of approximately 60,000 people has consistently registered some of lowest year-over-year property tax increases in Metro Vancouver over the last decade and beyond; and

Whereas the City of Port Coquitlam has proudly continued to expand core services for their residents and businesses including the recent addition of 57 free parking spaces in their downtown core; and

Whereas the City of New Westminster experienced a record high level of property tax in 2023;

BE IT RESOLVED THAT the Mayor request a meeting with elected officials and senior city staff from Port Coquitlam to explore if any of their best practices could be implemented locally with a goal of limiting future property taxes while enhancing service standards

Any motion that starts with inaccurate statements in the preamble needs to be considered in that context. This is far from a “record high” property tax increase, as compelling a political speaking point as that may be. It also seems like I have already had this conversation…

On the subject of the motion, I already noted that we had 9 hours of open workshop this year discussing every aspect of the City’s Budget – and the budget was on the agenda today during the meeting – and the mover of this motion had ample opportunity to ask questions of our experienced and professional staff about comparators or different approaches, and those questions were not asked by the mover. Since I was challenged in Council on this point, I encourage folks to watch the 9 hours of publicly accessible video of those workshops and not take my word for it. (they are all available here, The workshop dates were Oct. 16, Nov 20, Nov. 27, Dec 11, Jan 8, and Jan 22). You can confirm for yourself how proactive the mover was in those discussions.

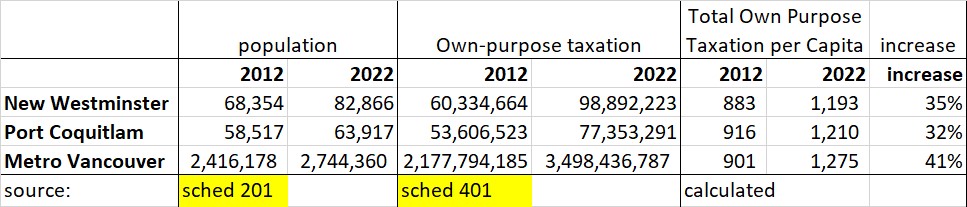

Further, every City’s budgets are open books – the Province even prepares spreadsheets and posts them comparing every City at the end of the year. Any member of Council or public can look at those spreadsheets and see where we are the same, or where we differ. You can not only compare us to PoCo, but to the other 21 municipalities in Metro Vancouver or the other 160 municipalities in BC. There is no “secret formula” or “tips and tricks” used by PoCo or any other City. Public Service accounting standards are used, and audits are publicly reported. The numbers below are not mine, they are directly from the BC Government site I link to above.

If a Councillor or member of the public does that bit of reading, they find PoCo’s increase of own-source taxation on a per capita basis has gone up 32% over the last decade (a timeline mentioned in the motion). New Westminster’s has gone up 35%, with both of us well below the metro Vancouver average of 41%:

At the same time, as there was significant speechmaking in the meeting about PoCo’s investments in infrastructure, PoCo’s 2024 Capital Plan is $33 Million. New Westminster’s is $152 Million. (the numbers I quoted in chambers were off the top of my head, and not accurate – these ones are).

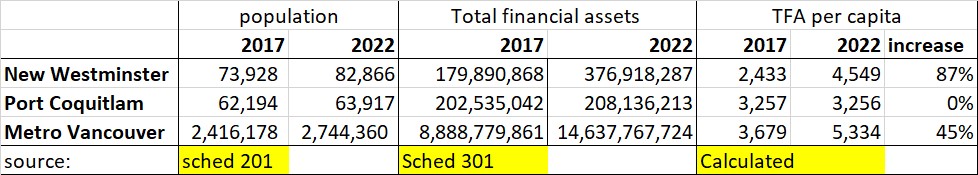

On the topic of best practices, we have talked at length with our staff over the last year and a half about the best practice of asset management. This has informed our ongoing effort to take a sustainable approach to asset replacement and a responsible approach to asset reserves. Besides spending much more on capital projects, there is a significant difference in our reserves over the last 5 years – the timeline when New West began its serious efforts to address Asset Management. In New West they have more than doubled and are now approaching the 5% of asset value that represents best practice. Over the same decade, PoCo has chosen to not invest in their reserves, and they have not grown at all, to the point where PoCo has some of the lowest reserves in the region. This is not secret, this is not trick, this is a choice.

Now, to be fair, this is not a competition. PoCo opened a new recreation facility in 2021, that puts downward pressure on reserves; we are opening our this year, and that will put downward pressure on our reserves. But the choice to assure our 5-year plan offsets this downward pressure over the term of the plan was discussed several times around the Council Table in the last year, and Council has made a clear decision to follow this accounting best practice. Every City is different and has different pressures. We don’t need to go to PoCo to lecture them about this, nor do we need to bother their staff when we have experienced, knowledgeable and professional staff here ready to answer any question the Councillor is willing to ask whenever they arise. in a public meeting. So I could not support this motion, because it wastes the time of professional staff in two cities.

Increasing support in Budget 2024 to enhance the work done by our local resident associations

Councillor Fontaine

Whereas our resident associations have a long history of engaging with City Hall and actively encouraging community participation and engagement; and

Whereas resident associations only receive $200 each to support the funding of their operations; and

Whereas the grants provided to resident associations have not been adjusted in recent memory and they are not tied to the rate of inflation;

BE IT RESOLVED THAT staff be directed to increase the annual resident association budget by up to an additional $200 in the 2024 operational budget; and

BE IT FURTHER RESOLVED THAT this additional increase in base grant funding be available upon written request of the resident association; and

BE IT FURTHER RESOLVED THAT resident associations with a bona fide and active membership base over 150 individuals on December 31st of the previous calendar year are further eligible to request an additional $200 in funding to support their operations

I hate to once again be correcting the information inherent in the preamble to a resolution, but grants provided to RAs were adjusted in very recent memory – about two years ago to address on-line engagement costs related to COVID.

Although I support the spirit of this motion, I was not in support of the resolutions as written. This is because it is not aligned with the requests made by Residents Associations themselves during our most recent RA Forum. Though I recognize the author of this motion was not present at the Forum, and may have not read the follow-up communications I sent to RAs and members of Council.

There was some direction given to staff to help work out a new model that supports the digital engagement the RAs are requesting (and technical assistance may be more appropriate than funding) more fairly reflects the new world of digital engagement, but also recognizes the varied nature of the RAs. Some RAs are in very strong financial shape and have tech-savvy volunteers, some don’t even request the small subsidy the City provides. If there was a more common concern, it was access to meeting space due to insurance challenges, and we are also working on better supporting them in that area. Those discussions are ongoing, and I hope we have some clear direction to take back to the next RA forum with some proposed solutions. What is important here is that we include them in those discussions to put support where it is needed, not just throw money at a problem when that has not been a clear request from the RAs.

Council agreed to provide a bit more funding to the RAs that request it in the short term, but the “bonus” for having higher membership clause was not supported. None of this takes away from the ongoing work we need to do to support RAs.

And that was the end of the business part of the Agenda!