I was prompted to write this post by a Twitter conversation last week. One of the local #NewWest Twitterati opined (not for the first time) that mining and exploration money will abandon British Columbia if the NDP are elected. His opinion seems worthy of consideration: although he is an outspoken supporter of the BCLiberals, he has also built his career in mineral exploration, so maybe this is more about the job than the politics?

Problem is, it contrasted with my (much shorter) personal experience with mineral exploration in BC. A few years after completing my undergrad, I worked a bit of the BC Geological Survey Branch, wandering around mineralized parts of Central BC helping put potential mineral exploration targets on maps. Ms.NWimby had a real job with the BC GSB, conducting geochemistry and drift exploration studies in other parts of the Province, for much the same reason.

At the time, exploration in BC was suffering. There were not that many jobs in BC for just-out-of-school grads in geology. True, the NDP were in office, but I don’t remember anyone talking about that. When talking to small placer miners up the Omineca Mining Access Road, they were talking about one thing only: gold prices. There were sole operators up there who were putting all of their gold into safety deposit boxes, because at under $300/ounce, it wasn’t worth selling.

When Ms.NWimby and I moved to Illinois, we went there to work for the Illinois State Geological Survey, partly because the writing was on the wall for the BC GSB. The message from the incoming Liberal Party was to not expect any investment in the BC GSB: layoffs were coming, and it was time to pull up stakes and find other opportunities if we wanted to do geological science.

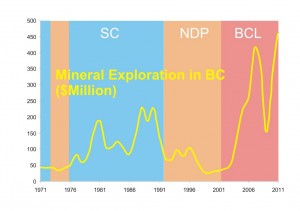

So I thought I would look back at how BC governments have impacted exploration spending in BC since Dave Barrett’s rule. Easy. The BC Government produces a list of historical annual exploration expenditures in the Province. Not Government expenditures, mind you, but private sector investments in the future of BC mineral industry. This is the money that disappears quickly when the private sector get scared that the Government of the day is “unfriendly”. It is also a much better measure of “industry confidence” than actual mining revenue, as mines take a long time to set up, and once operating, carry a lot of momentum – so they tend to last through multiuple administration changes.

Aside from thsi single event, we need to think about where this exploration money comes from – selling stocks in Junior Mining Firms. When people invest in these companies, they are, of course, thinking about potential return-on-investment. That return is essentially based on two things: the company’s chances of finding a marketable amount of metal, and the price of the metal when they market it (don’t start me on the whole pump-and-dump factory that was the VSE). Read any junior mining prospectus, and those are the two things they talk about at length.

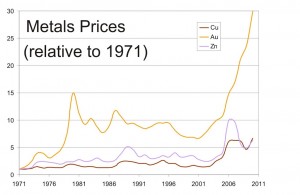

So what happened to metal prices over that same period? (please follow links to find the Government references to all the data I use below, I don’t make this stuff up)

I went to the USGS and looked up their historic mineral stats to find the value of those metals as commodities on the world market. I then compared that to the actual minerals BC produces the most of. According to the Government of BC, 59% of BC’s mineral industry value comes from Copper, 17% from Gold and 11% from Zinc. Essentially, 87% of the money BC makes from mining metals comes from these 3 metals, and their value has changed over the last 40 years:

To combine this into a single graph, I turned all three numbers into price indexes. I divided each year’s price by the 1971 price, so this graph shows the value for the three metals compared to their 1971 value.

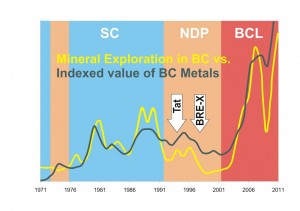

Notice gold changed more than other metals, but represents only 17% of BC’s metals wealth. So I multiplied the numbers above by the percentage of their proportion of BC metals wealth, according to the BC Government stats from above (Copper *0.59 + Gold *0.17 + Zinc *0.11). We get a single graph of the change in value of 87% of BC’s mineral wealth over the last 40 years, not due to Provincial Government action, but simply due to the fluctuations in global metals markets:

Then lets project that graph over the original one showing exploration spending:.

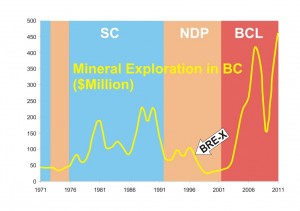

Then I ask you, does it look like the government in Victoria has as much effect on the amount of mineral exploration money spent in BC as the global metals markets? Who was more responsible for the jump in the late 1970s- Bill Bennett or the Hunt Brothers? Was Gordon Campbell responsible for the value of gold taking off after 2001? Was the NDP responsible for Bre-X?

Even the greatest “socialist” insult to mining exploration – the dedication of the Tatshenshini-Alsek Provincial Park, which killed the massive Windy Craggy Mine project – is hardly a blip in the exploration-investment graph (it took place in June, 1993), despite what the Fraser Institute may say. I added that arrow, only to contrast the impact of the Tat announcement with that of the Bre-X fraud. (Funny, the Fraser Institute site returns no searches for “Bre-X”).

So unless Adrian Dix has the power to single-handedly manipulate the world metals markets, I will treat the “NDP will kill mineral exploration” meme as just another case of political hyperbole that doesn’t fit the data.

One could just as easily say that the positive or negative effects of past governments is muddied by the highs and lows in metal prices. My opinion is that they work in tandem and that, at least in the negative sense, one ads insult to the injury caused by the other. There is likely a feedback process in play – lows get pushed lower by unsupportive governments and highs get pushed higher by supportive ones – is this not logical?. A single variable explanation involving only a metal index is too simple.

I don’t think there is much that can be done to significantly improve the mineral investment situation during times of low metal prices and stock market scandals, but there are plenty of things that can be done to make it worse. We saw this with the last NDP government and I think we’re about to see it again.