One of the changes we have made in the City in recent years is moving the budgeting period up a little, meaning we are able to get the 5-year Financial Plan bylaw through Council in January, where we used to do it a little later in the spring. The true deadline for us to get this work done is the annual financial reporting deadline to the province that comes in May, but it is better practice for us to do this work earlier in the year so that staff can more easily develop annual work plans around an approved budget, which will hopefully lead to some efficiencies and make it easier to get things done in City Hall.

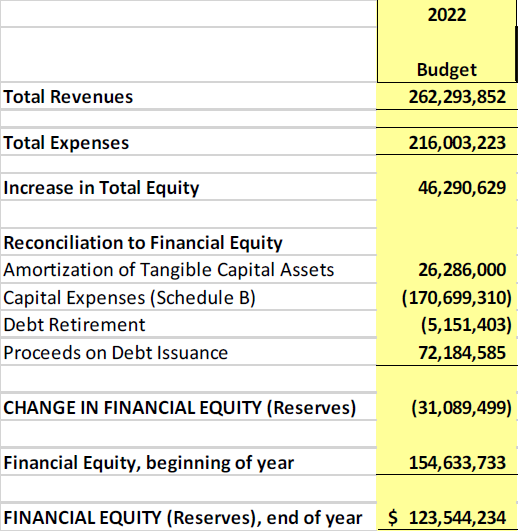

Council gave first readings to the 5-year financial plan last meeting, which means the budget is, effectively, passed. The headline (4.4% tax increase) has already been told, but I promised to write a bit more the Budget and how we got there. The 2022 budget part of the 5-Year Financial Plan looks like this:

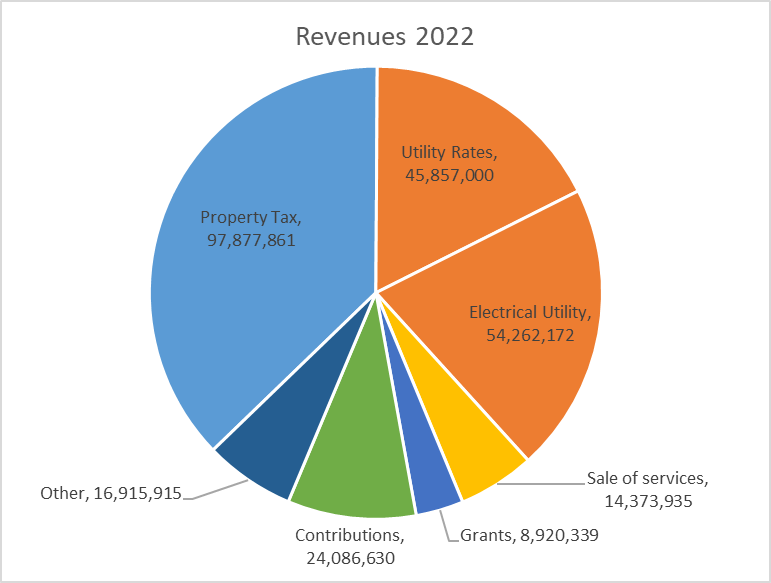

On the revenue side, we are anticipating an overall 8.9% increase in revenues over the 2021 budget, with the increase in property tax revenue at 4.4% (after all, only about 37% of the City’s revenue comes from property taxes). As has been much discussed, New West is unique in having an electrical utility, so that $50+ Million in annual revenue always makes it look like our revenue per capita or per household is higher than other cities in the lower mainland, when we are usually about average after adjusting for the Electrical revenues, but that’s a topic for another blog post.

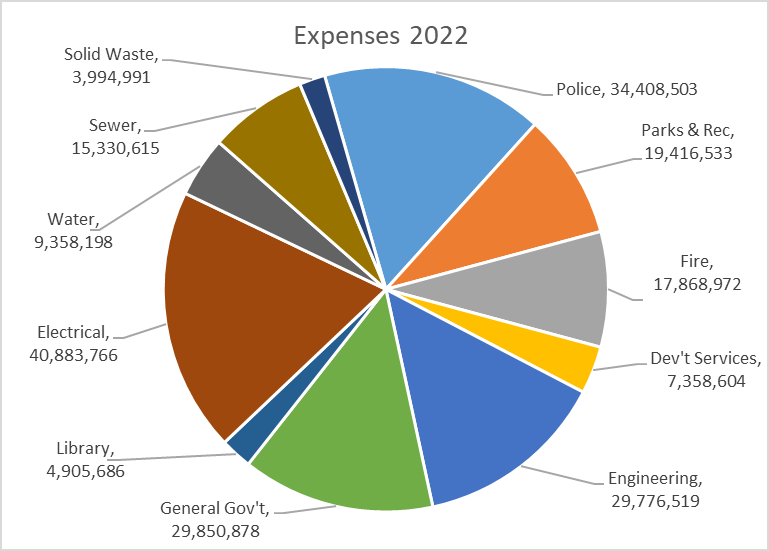

On the expenses side, this is where the City is spending that money. 2022 Expenses are about 4.8% higher than last year:

The biggest change this year in our General Fund (the part property taxes go toward) is to insurance rates. As always, we are subject to inflation on everything we buy, and inflation was high this year for the things cities like to buy, from fuel to lumber (our “basket of goods” is quite a bit different than the CPI). So a tax increase equaling 2.7% (out of the total 4.4%) is a combination of negotiated wage increases in the 2% range and inflationary increases in the cost of the business of running a City. On top of that, the same global insurance market situation that has caused your Condo and/or house insurance to skyrocket is also impacting the City. We will be paying $1.5 Million more on insurance in 2022 than 2021, which adds another 1.6% to the tax increase on that line item alone. We had a few service enhancements adding up to the equivalent of about another 0.8% increase, but saved some money in not operating the CGP and staff found some other savings in internal functions, meaning we effectively offset most of that 0.8% with savings.

On the utility side, we are seeing a continued trend toward increases higher than CPI, driven by increases in regional utility service costs and our need to keep the local assets maintained. I wrote about how our Utility funds work with some flow charts to show where the money goes a few years ago here, and though the numbers have gone up a bit, the effect is the same. Notably, both in the Water and Sewer we are a little ahead in both capital spending and building up our reserves than we were back when I drew those diagrams, so the financial health of the utilities is improving faster than expected, which I hope translates to a moderation in rate increases in the years ahead.

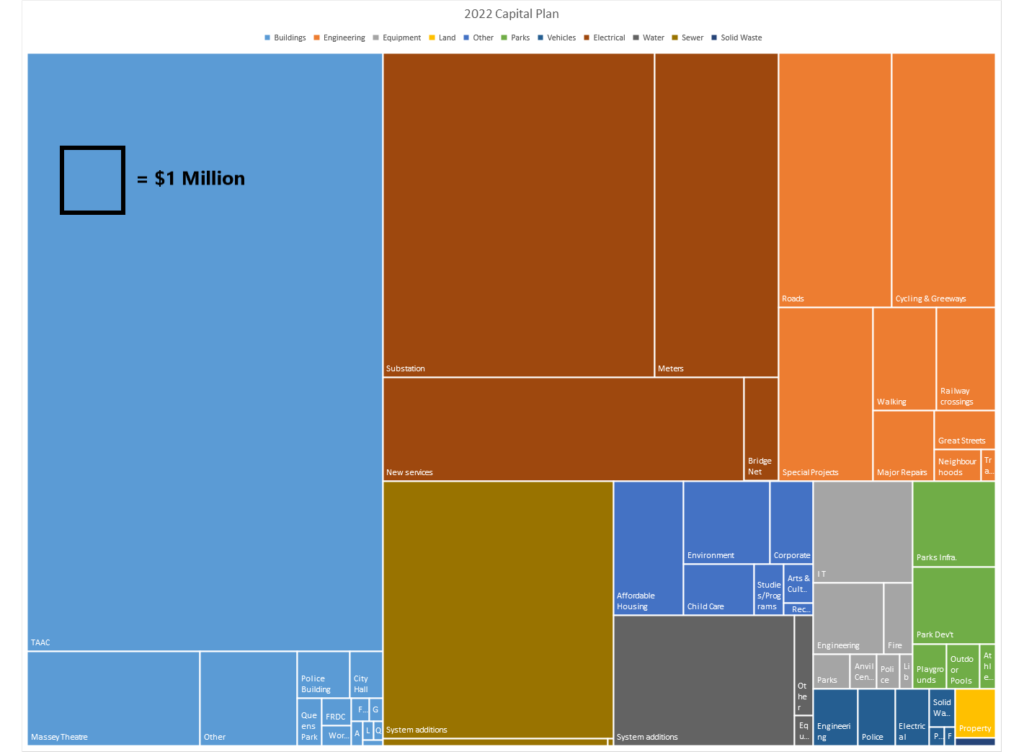

With $262M in Revenues and $216M in Expenses, we end up with a budgeted $46M increase in financial equity. But it would be premature to call that profit, because diligent readers will remember my constantly talking about our aggressive Capital Plan, which requires us to be converting that equity into capital assets, better translated as “building stuff”. The big number to note in the reconciliation of assets part of the table is the $170M in Capital expenses. it bears repeating that this is the big year for a couple of capital projects. We are budgeting $54M in 2022 towards the təməsew̓txʷ Aquatic Centre, almost $43M in upgrades to the electrical grid (including a new substation in Q’boro and replacing all of our meters), $7M in road rehab and $6M in new mobility lanes. If you want details on everything, look at the tables of planned capital expenses starting on page 64 of this report (warning – it’s a big download). It’s all there. More graphically, the $170M 2022 budgeted capital pan looks like this (with the black square representing $1M):

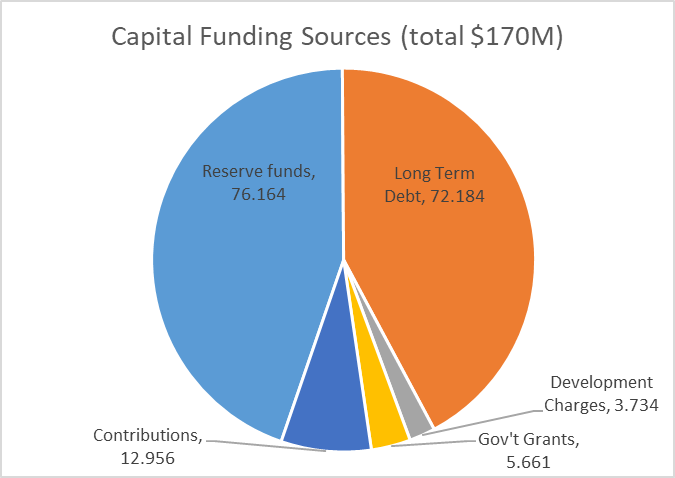

So, the City may plan to put $46M into reserves this year, but we also plant to take $76M out of reserves to pay for about half of that capital plan. This is based on a strategy that balances between drawing from reserves (“spending our savings”), borrowing against the asset value with long-term debt (“securing a mortgage”), and getting others to pay for it (grants form senior governments, money from developers through DCCs, etc.). I’ve written about how municipalities approach this balance in this older blog post. In practice, the balance looks like this:

So to wrap up, the City of New West is once again somewhere in the middle in the region as far as tax rate increases, has weathered the economic uncertainty of the pandemic, and is moving ahead aggressively with some long-awaited capital improvements.