The March 7, 2016 Council meeting began with the annual tradition of the May Day Draw. I’m not going to delve too deeply into this, but it was noted to me that this event was held the day before International Women’s Day, where we are asked to think about everyday examples of patriarchy in our lives.

The following items were moved on Consent by Council.

2015 Freedom of Information and Protection of Privacy Act Report

The City is subject to the Freedom of Information and Privacy Act. We get FOI requests on a pretty common basis, for a variety of reasons. This report lists the statistics for 2015. We had 72 requests for FOI documents, released 1,041 pages of paper documents and 3,170 pages of electronic documents. One request was forwarded to the Office of the Information and Privacy Commissioner (OIPC).

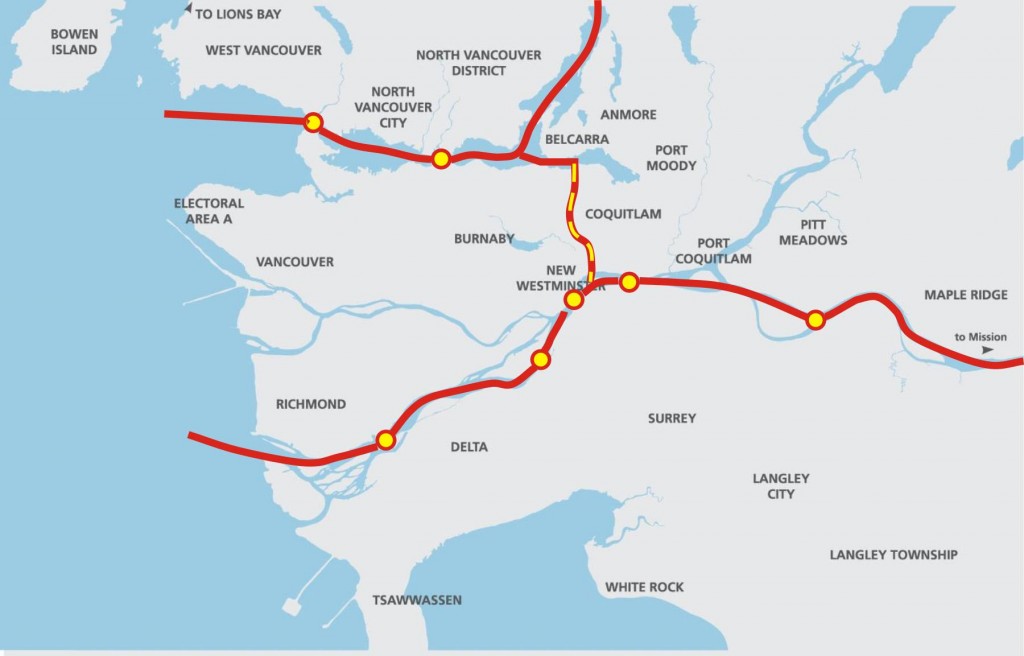

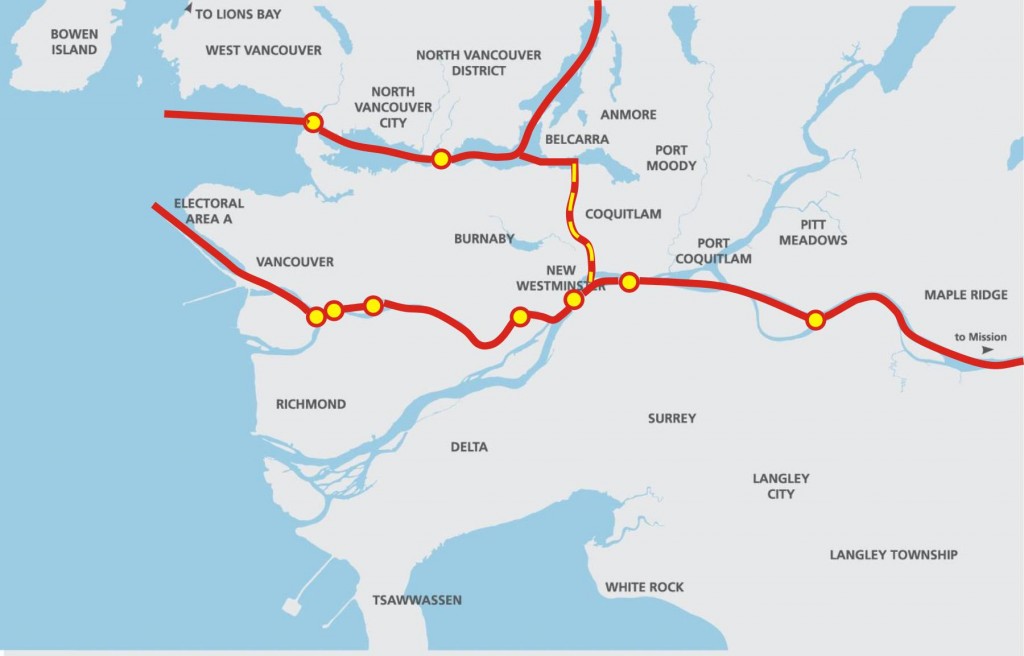

Status of Trans Mountain Pipeline Expansion Review Process

This is an important issue for our City. Although the pipeline as proposed does not pass directly through our City, it passes very close to us, and more importantly passes right through the lower reaches of the Burnette River watershed, within metres of the River itself. After 50 years of hard work by Elmer Rudolf and the Sapperton Fish and Game Club to restore this urban water way – to bring salmon back to a river that had been devastated by a century of industrial pollution and neglect – the Brunette is too important a resource to risk. So it is important that we had representatives taking part on the NEB review process. Our consultants were there to provide solid scientific back-up, and we had Elmer help with describing the threatened habitat from a first person perspective. Our goal all along was to make sure that the protection of the Brunette is part of the decision making by the Federal government about whether, and under what conditions, this project moves forward.

This is not an Environmental Assessment the way many may think it is – it is an evaluation of the project by the National Energy Board, currently chaired by the former Deputy Minister of Oil for the Province of Alberta, with members that represent the broad range of oil and gas industry interests. The (new!) federal government last month announced an extension of the NEB review process to allow other Federal Departments to fill some gaps in First Nations Consultations and upstream GHG emissions, so we don’t expect to hear a decision from Ottawa on this project until December of 2016.

Recruitment 2016: Century House Association Representative on the

Seniors Advisory Committee

The CHA always nominates a representative to our SAC, and this report formalizes that appointment

.

900 Carnarvon Street: Housing Agreement (Bylaw No. 7810, 2016)

The building proposed for 900 Carnarvon (the “4th Tower” at Plaza 88) went through a Rezoning Public Hearing back on September 28, 2015, and Council gave the Rezoning Third Reading. One condition on this Rezoning is that the building would be a market rental building, in part to address a rental vacancy rate bouncing around 1% regionally. This housing agreement will secure that market rental condition for the life of the building (60 years). Council moved the recommendation to give this Bylaw three readings.

320 Salter Street: DVP and DP for a 91 Unit Secured Market Rental Housing Project

Move recommendation This is another project in Port Royal where we are securing market rentals. The zoning was adopted back in 2014 (before I was on Council) and we are now at the Development Permit stage. Council moved to bring this Permit to the April 4 Meeting for an Opportunity to be Heard. C’mon out and tell us what you think.

New Westminster Child and Youth Friendly Community Strategy

This is an interesting strategy the City has been working on in recent years to make sure our City has the infrastructure, programs and supports in place to be truly “family friendly”, by assuring it is a safe, supportive, and inclusive City for children and youth. There are a lot of good initiatives in here that will bolster our Family Friendly Housing Policy. I don’t have kids, but am keenly aware of transportation issues, so I am glad to see the strategy include a “Moving Domain” that addresses transportation gaps in the West End and Queensborough, safe routes to school, lowering speed limits and increased pedestrian protection in residential neighbourhoods,

Update on City Responses to Assist in Refugee Settlement and

Integration

There is a lot going on locally to support refugees that are arriving every day, including the work that social service agencies like ISS are doing (and have been doing for years before this latest crisis). Amongst other measures, the City has agreed to help organize and assist with financing of a “Newcomers Connect Day”, coming up in April.

The City is also working on updating our Newcomers guide, which includes materials to reduce barriers to local government, such as instructions on things many take for granted growing up here: what City does, where your garbage goes, when you should call police, how to get access to permits, parking, libraries, sports and recreation, etc.

235 Durham Street: HRA Amendment Bylaw No. 7817, 2016

This is an Agreement to amend a Heritage Revitalization Agreement prepared back in 2013 to extend the timeline for the restoration work, mostly due to the unexpected death of one of the parties to the agreement. Council moved to give the Bylaw which would allow the extension three readings.

Request for Support from Ladner Sediment Group

This is a group of residents and businesses in Delta who are mostly concerned that the Federal money for maintaining dredging in the Fraser River dried up under the previous government, not unlike almost every other program to support communities. Although the idea of advocating for dredging money is good for Ladner, I think that the larger dredging, flood control and diking program needs a basin-wide approach, and that is why New Westminster is active in supporting the Fraser Basin Council approach.

Additional Community Grant – Hyack Anvil Battery

The Ancient and Honourable Hyack Battery Salute is one of those quirky things about New Westminster that makes us unique. Every once in a while, we are asked to contribute a bit to help keep some of these traditions happening, and I am happy to support the renewal of uniforms for this organization. Our grants budget has a bit of unexpected room from last year, so this one-time grant is outside of cycle, but within our larger spending envelope.

2015/2016 Electrical Utility Rates

Yes, your New Westminster Power rates are going up 4%, in order to match the increase in wholesale cost for electricity in the City. A quick reminder about New Westminster Power: we pay the same rate per KW/h as other BC Hydro customers in the province, we have one of the most reliable electrical systems in the Province (notice how your lights didn’t go out during this week’s windstorm), and the Utility returns a small profit to the City coffers every year, helping to keep your taxes down. I think we have a good thing going here.

Filming Policy Amendment, Film Permit Bylaw No. 7793, 2016 and

Bylaw Notice Enforcement Amendment Bylaw 7814, 2016

We are updating our filming policy and are creating a new Bylaw to give the policy a bit of teeth. After a pretty minor edit following the last time this came tio Council, we moved to adopt the new policy and send the Bylaw for three readings.

1209 Hamilton Street: Proposed Rezoning

This duplex home just a half-block off of 12th Street is being set up to become a Day Care. It appears to be a good layout and location, but requires a rezoning. Council agreed to direct Staff to process the application as per usual, launching this plan into the entire Rezoning rigmarole. Coming to an Open House near you!

Brewery District: Rezoning Application and Master Development Permit

Amendment

This amendment to the Master Development Permit and Rezoning for the Brewery District has been back and forth between public consultation and Council for a bit, and this was one more chance for Council to comment on the changes.

Formally, the changes are to the density of the second residential building to accommodate some secured market rental, a change in density distribution (and height) to the third and fourth residential buildings, a density increase to the final phase commercial building, and a few accessory changes around land use.

I continue to be concerned about the traffic impacts here, and am happy to see that more is being done to move some access off of East Columbia. We need to shake off the idea that Brunette cannot be a used for access. I’m even happy, at this point, to see a controlled intersection installed on Brunette to further take the load off od East Columbia and discourage the use of Alberta, Kearey, and adjacent roads uphill from East Columbia from becoming commuter routes. The traffic/parking consultant for the project recommends moving access to Kearey Street, which may align well with RCH expansion plans, but a creative solution is required here as well, to prevent Kearey becoming a rat-running route. I hope Wesgroup will work with RCH to align their common approaches (and told them as much in Land Use and Planning Committee).

As much as I would love to see a Brewery at the Brewery District, I am cautious. I don’t know of another example in BC where an active brewery shares space in mixed commercial-residential development, and Breweries can be smelly and a little noisy at night. A Brew Pub or Tap house may be perfect, but an actual on-site brewery may need to be approached with caution.

École Qayqayt Elementary School Public Art Funding Request

I love this. I think this is a great use of Public Art funds. It is local, includes an educational component, is a permanent fixture, and is matched in finds with an outside partner. It is easy to say yes to this one!

The following items were Removed from the Consent Agenda for discussion:

Q2Q Pedestrian and Bicycle Bridge Review Process, Community Consultation

I feel like I have written a lot about this already, but here we go again.

I am a cyclist, a pedestrian, and have always been an advocate for sustainable active transportation, and for creating a permanent, fixed, reliable and accessible active transportation link between Queensborough and the Quayside. It is an important piece of the City’s waterfront vision, of our Master Transportation Plan, and for the development of our community in the whole.

However, this project is causing me more stress than anything else we are working on in the community today, mostly because I am very afraid we are not going to be able to build a project that is acceptable to the community.

The strong public support shown in 2013/14 consultation was for a design that we have now determined the Marine Carriers would not support – because it was low elevation, it was accessible, it had low visual intrusion and it provided reliable emergency vehicle access. One by one, we have removed those factors and are no longer building a transportation link, we are building a terribly expensive parks amenity. That would be a disaster. If we build a bridge that isn’t accessible and reliable for the ultimate users, it is going to be a lost opportunity.

So the design work continues, and the public consultation continues, but at this point I am hoping that the design consultants can pull a rabbit out of the hat, and can re-build my confidence that this project is still viable.

In the meantime, I think we need to re-engage with the Marine Carriers and the senior government agencies (Transport Canada and Port Metro Vancouver) that hold the navigable waters regulations. I respect the needs of the marine carriers and their expertise on marine operations, but the river belongs to all of us, and this community deserves and equal say in how our river is used.

I also put forward a motion to want to clarify the process for First Nations consultation. Although a pre-approval process through Port Metro Vancouver has initiated some discussions, I have learned through my participation I several Environmental Assessments over the last few years that it isn’t good enough anymore to tell First Nations what we plan to build and ask for comment. We need to engage their leadership early and make sure they are updated and aware long before formal discussion of design concepts are brought in. It is about relationship building, and I would prefer if we reach out Council to Council. This discussion should not just centre on the Q2Q, as this is an opportunity to check in and talk about the City’s Waterfront Vision in its entirety, and invite those First Nations to meet with the Council and discuss issues, concerns, and opportunities related to this bigger idea.

Ditch Infill and Urban Streetscape in Queensborough

The biggest issue in Queensborough (battling traffic and the general sense that “no one over there cares about QBoro” for that title), is how we are going to manage the remaining ditches in residential areas. The ditches are an important part of the drainage system for QBoro and Lulu Island in general, and also provide ecosystem services. Some people love the frogs and dragonflies, some hate the mosquitoes and murky water.

Filling in the ditches would require significant infrastructure costs, because an open ditch can hold and move a lot more water than a closed pipe that would easily fit in that ditch. Then you have to build curbs, gutters, storm catch basins, and connecting pipes, and in a place with no natural grades like Q’boro, you need to build grades and pumping infrastructure to keep things moving out to tidewater.

This report outlines the strategies the City will use to move towards closed drainage in the neighbourhoods where people want to go that way. Part of the cost will be on the city, some will be on developers who build new developments (and receive up-zoning benefits from that development) , and some by residents through special assessments.

We then moved on to the most exciting call-and-response part of every council meeting: Bylaws!

Film Permit Bylaw No. 7793, 2016 and Bylaw Notice Enforcement Amendment Bylaw No. 7814, 2016

As discussed above, these Bylaws regarding Film operation in the City was given three readings.

Electrical Utility Amendment Bylaw No. 7816, 2016

As discussed above, the new electrical rates bylaw was given three readings.

Housing Agreement (900 Carnarvon Street) Bylaw No. 7810, 2016

As discussed above, the Rental Agreement for Plaza 88 building 4 was given three readings.

HRA (235 Durham Street) Amendment Bylaw No. 7817, 2016

As discussed above, the Bylaw to grant this HRA extension was given three readings.

Erosion and Sediment Control Bylaw No. 7754, 2016

Bylaw Notice Enforcement Amendment Bylaw No. 7819, 2016

As discussed back on February 1, this Bylaw and the supportive changes of the Bylaw Notice Enforcement Bylaw were Adopted. It’s the law of the land, folks, please adjust your behavior accordingly.

Commercial Vehicle Amendment Bylaw No. 7777, 2016

As discussed back on February 15, this Bylaw on how we manage Taxi driver licenses was Adopted. It’s the law of the land, folks, please adjust your behavior accordingly.

HRA (205 Clinton Place) Bylaw No. 7800, 2016

Heritage Designation (205 Clinton Place ) Bylaw No. 7801, 2016

This Heritage conservation project went to Public Hearing on February 29, and the supporting Bylaws are now Adopted.

HRA (335 Buchanan Avenue) Bylaw No. 7802, 2016

Heritage Designation (335 Buchanan Avenue) Bylaw No. 7803, 2016

This Heritage conservation project also went to Public Hearing on February 29, and the supporting Bylaws are now Adopted.

And we were done!