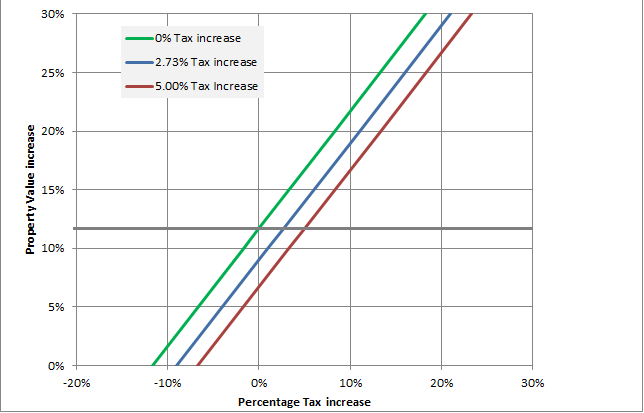

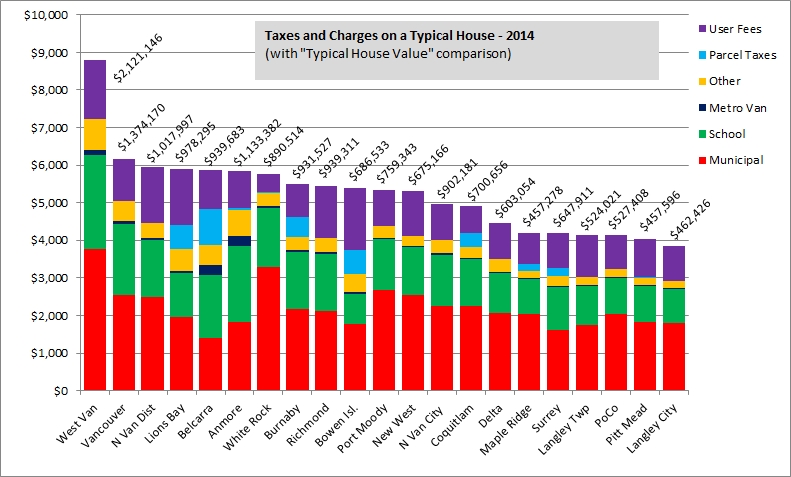

We are through the annual budgeting cycle at City Hall, our 2016-2020 Financial Plan passed, our tax increase bylaw adopted with a 2.73% increase for 2016.

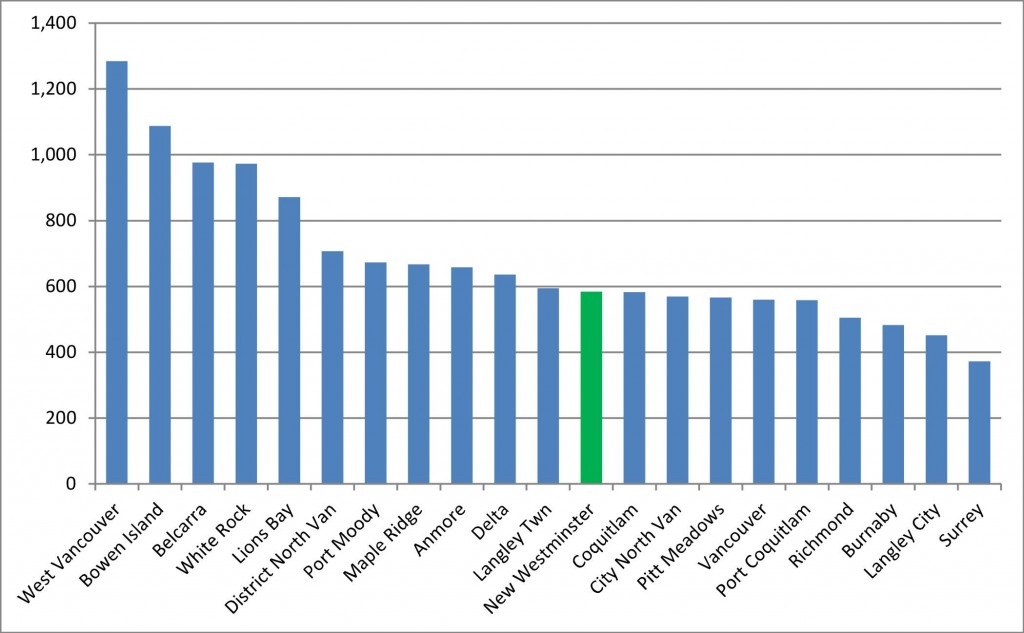

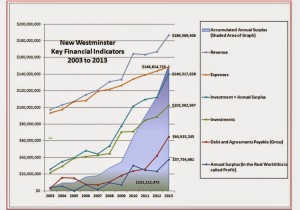

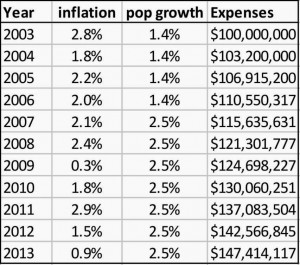

I tried during this and previous tax seasons to talk about the hows and whys of our Property Tax system, but there is one topic I didn’t really touch on. It is a topic raised commonly by local contrarian, cyclist, and generally good guy, Ed. I am paraphrasing a collection of Twitter missives a bit, but my understanding of Ed’s position is that property tax increases should be limited to CPI increases, or matched to inflation. In this post where I compared New Westminster’s tax increases to the inflation rate, you can see that we are, and have been for more than a decade, above the CPI rate (which is projected by the Province of BC to be 1.9% in 2016), as is every other City in the Lower Mainland. Why?

It shouldn’t be too much of a surprise. Every year as a part of the budgeting process, staff bring recommendations to Council about new spending, and provide us (and the public) a pretty clear picture of how much each new staff position, program, or service will cost Taxpayers, right down to the percentage of tax increases. Some of those positions, programs or services come with offsetting cost savings or revenue potential, but in the end it always seems that taxes need to go up, it is just a question of how much.

I’m going to skip a little bit past the easy political talking points: downloading, deindustrialization, and economic bleeds caused by decades of neo-liberal economic policy. That’s not to say these factors should be blithely dismissed; indeed they are real pressures on local governments, and may be the biggest factor in ongoing tax increases. Maybe in another blog post I’ll try to explain what is wrong with the entire world economy (better if you just go read Umair Haque), but for now I am going to keep this local, because we are asking what we in Local Government can do about this.

There are many drivers that push up the cost of running a City the same way they push up the cost of running of your business or household. Just as you pay more every year for food, utilities, banking charges, transportation, and taxes, the City pays more for wages, equipment, supplies, banking charges, utilities, etc. As Ed astutely observes, those increase is (more or less) related to the Consumer Price Index.

There may be long-range factors that impact how closely our operational costs match CPI year-to-year. For example, a long period of ignoring our infrastructure means it will be more expensive to repair when the situation becomes critical. Similarly, if we have extended periods where wages are not keeping up with inflation, that will come back to haunt us.

There is a third factor, however, that is completely in control of local governments and the electorate that empower them. Every year, people want more from their local government, and more never comes for free. To give examples of this, I think I can divide that “more” into three general categories (recognizing there is a lot of overlap between the three): new needs, new programs, and new approaches.

New Needs are things we have to do now, that we didn’t really have to do in the past. There is some aspect of “downloading” to this, but most of it is just a result of changing times. We currently train a group of our NWFD force to respond to Hazardous Materials incidents, in case one happens at the railyards in the City. This was partly a response to the tragedy at Lac Magantic, partly an increased awareness of the hazards that exist in our community and a demand from the public that we do all was can to address those concerns. Another example is the new policy that every single sidewalk corner will have a “let down” to make all of our sidewalks accessible for those on wheels, those pushing children in a stroller, and those with other mobility limitations. We are similarly spending money upgrading all of our bus stops to meet accessibility standards. These are just a couple of examples of things we now do that we did not do in the past, and they all cost money – more money than we collected in the past.

New Programs are things that we have chosen to do because people want them, but are (arguably) not “needs”. I was at the Youth Awards held last week at Century House, and was reminded about the programming we offer in our (still brand new) Youth Centre, a facility used by literally thousands of local youth every year. We have recently been discussing infrastructure upgrades at the Library, and I am learning how they provide the only access to the internet for a significant portion of our community. Everything from interacting to government agencies to applying for jobs is impossible in 2016 without internet access, and the needs of the community are outstripping the computer terminals we have. We are currently replacing one of our all-weather fields for the princely sum of $1.5Million, because it is past its service life. We do this because a plastic turf field is about 5x more used than a grass field, and we can offer much more programming on a limited amount of space available in the City. Our Police Department has officers specially trained to determine when a person is suffering from a mental health issue, and manage their approach in a way that is less likely to result in violence or self-harm for the member of the public. Again, new, modern problems all around, not things we did 20 years ago, but things that our community expects in 2016.

New Approaches are things we have always done, but do very differently now, often in ways that are more staff or resource intensive. I am sitting in on the Public Engagement Taskforce, a group of staff and public volunteers looking at better ways for the City to reach out to the public they serve, both so we can keep the public more informed and so we can get more meaningful feedback from the public when we need to make decisions. The way we, as a City, have turned the Official Community Plan update into a two-year-long public conversation about the future of the City, instead of just a small collection of staff and a few councillors attempting to dictate the future, is an example of how resource-intensive true engagement is, and how important it can be to a community. Again, it seems obvious to us now, but not something we expected 20 years ago.

This is not to say there is nothing we can stop doing or paying for as times change: we save a bunch of money on pesticides with the new approaches to weed management in the City; our fleet fuel budget is going down as we upgrade to a more efficient vehicle pool; the cost of running our solid waste program is definitely increasing at a rate less than inflation as efficiencies are found. Our mental health officers will likely result in lower crime levels, better supports for marginalized people, and law enforcement savings down the road. Building pedestrian-friendly streets will reduce the use of cars in our city saving us money in road maintenance, emergency response, and health care costs. There are also efficiencies of scale as population increases and density makes provision of services more convenient. But the reality is that pipes in the ground and mowing lawns are costs that track along with the CPI, and no-one is lining up to propose which programs they want to see cut in the City. New approaches to new problems are inevitably added to the bottom line.

Every election, people come along saying they will freeze or lower taxes, but do any of them provide details of how they will do it? I still fondly remember former Mayor Wayne Wright in the 2011 election shutting a rather vitriolic opponent down at an all candidates’ meeting by calmly saying “Cutting taxes is easy. It’s the easiest thing for us to do. Just tell us which programs you want to cut to make it happen”. There was no retort, because he put a lie to the “find efficiencies” and “set priorities” memes that neo-liberals use when their real goal is to undermine public services at every scale, from public transit to schools to health care.

It is also telling that even the most strident of anti-tax crusaders find that in Local Government, the bills are always coming due because we have to answer the phone when someone loses a service or program important to their lives.

As a Council, the toughest part is setting priorities. You get elected hoping to do a lot of great stuff, and run up against limited resources and an over-burdened agenda of 7 Council Members. I would love for us to develop the Gas Works site into a public art curator and public park, to complete the Sapperton Landing to Pier Park greenway connection, to build an architectural wonder for a Q2Q bridge and a energy efficient family-friendly and competition-supporting Canada Games Pool. While we are at it, I want to fill the funding gap of senior governments that is threatening the very existence of our supported Co-op housing sector, build a fully integrated and interconnected bikeway network, and plant 10,000 trees to bring our urban forest back to the national average for tree canopy. These are all important things, and they all cost money, and they would all result, eventually, in tax increases above that of inflation. We can probably avoid significant tax increases if we do none of them, along with not doing a list of other things that would make our community better.

So every year at tax time, and actually throughout the year, when new programs or better services are presented to Council, we evaluate them. We try our best to understand the long-term budget implications, ask how or if these ideas can offset costs other areas (“find efficiencies”), and determine if this is something needed right now, or if it can be put off (“set priorities”), and we hear from the public about how critically important, wonderfully visionary, or economically savvy each new idea is. And we make those tough choices, and often we say no. That’s the job.

When people say “The City should…”, I so often want to respond with “Let’s do it!”, but instead end up saying “I wonder how we could…”. That (along with no longer fully enjoying the Letters to the Editor section) is probably the biggest dose of reality going from being a community rabble-rouser to an elected official. I agree with Ed, with former Mayor Wright, and (though I shouldn’t speak for them) with my Council colleagues, that we need to be diligent at finding ways to save money, find efficiencies, and keep our taxes as low as possible. But much like Jordan Bateman, I agree that we have a responsibility to the present and future residents of the City “to build the infrastructure that will keep them safe and healthy… we must balance both present and future needs”

![]()