Welcome back. We took Council on the Road for the last meeting of August, meeting at the Anvil Centre in beautiful, historic Downtown New Westminster – Western Canada’s Original Downtowntm.

For the first meeting after a month-long break, it wasn’t as packed an agenda as one might expect, although there were a significant number of proclamations and presentations that are worth your time to watch on video.

We also had a bit of commentary about the windstorm from the Chief of Police and the Director of Parks. The short version is that our Fire and Electrical Utility folks did an exemplary job, got almost everybody’s lights back on within 24 hours, and managed a huge call volume through activation of the new Emergency Operations Centre at Firehall #1 to take a bit of the load off of the swamped central E-Comm system. This was a relatively small emergency, but was a good test of our response capabilities, and will be a learning experience going forward.

It should also be a learning experience for people like me, who were found wandering the streets of Uptown on Saturday Night trying to find a meal and a place to plug my mobile phone in (both successfully located). I will try to pop out another blog post this week about Emergency Preparedness, and what we should learn from this event.

As usual (but for the last time ever?) the meat of the meeting involved covering Recommendations from the Committee of the Whole.

FCM encouragement for Federal Leaders Debate

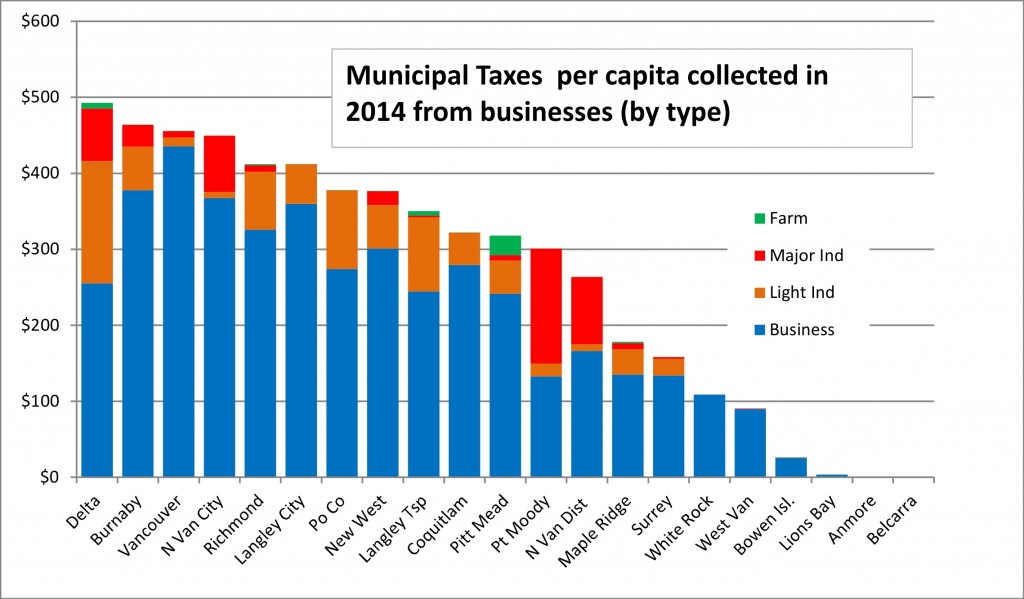

I don’t know if you noticed, but there is a federal election happening, and Federation of Canadian Municipalities is attempting to the get the leaders of the major parties together to hold a debate on the topic of “municipal issues”. As a Council, we support this initiative, as there are numerous Federal issues (the Long Form Census and reinvestment of the Federal Gas Tax pop immediately to mind) that have a direct impact on Municipal governments, including New Westminster.

Land Use and Planning Committee

This is part of our new Council format, where the Council will no longer be meeting as Committee of the Whole. In part to reduce the workload on the newly expanded evening meetings, and also with the intent to serve the public better in providing more timely responses to “development” questions, we are setting up a Land Use and Planning Committee. This will comprise two Councillors and the Mayor, supported by a few relevant staff members, with the plan to meet earlier in the development process and provide more detailed reviews of potential projects and potential pitfalls. The LUPC will serve as advisory to the whole of Council, and will hold their meetings in public.

I’m excited to be serving on this committee for an inaugural two-year term, and am interested to see how we can make the development process smoother for developers, and more open and transparent for residents.

Development Variance Permit – 302 Fifth Ave

This is a simple request to replace a garage with one that is quite a bit taller than is allowed in the zoning. The City limits garage or outbuilding heights in part to reduce the unregulated conversion to living space, and also to reduce the visual impact on adjacent properties. In this case, the proponent was requesting a taller height so the garage matches better the unique roofline of the house, was building the garage with a truss design that prevented the upper part of the garage from ever being converted to living space, and the two closest neighbours provided letters indicating they were not opposed to the larger size.

With that information in hand, Council agreed to consider the requested Development Variance at the September 28 meeting. If you have an opinion, you should let us know before then!

Development Variance Permit – 1258 Ewen Ave

This is a request to build a new house in Queensborough 10 inches higher than permitted, which would make it the same size as the adjacent houses. Council agreed to consider the requested Development Variance at the September 28 meeting. If you have an opinion, you should let us know before then!

Housekeeping Amendment Bylaw

This is to make several housekeeping changes to the existing zoning Bylaw. The changes are:

• Changing the wording of the bylaw so the reference to the professional organization that oversees massage providers matches the language of the actual professional organization;

• An adjustment of the density formula for RM-6 and C-4 districts to make the formula actually work properly and as intended for smaller sites;

• Clarifying some language in at-grade commercial requirements in the C4 district;

• An amendment to allow animal care operations in CD-19, to bring it in line with other commercial districts of the type; and

• An amendment of the language for how corner cuts are defined for properties with front lawns.

Exciting stuff, I know, and these changes will go to Public Hearing on September 28, 2015. C’mon out and tell us what you think!

Development Permit 26 E Royal

This is the final development site at Victoria Hill, which will provide some long-awaited commercial property in the centre of the neighbourhood as part of two 4-story residential buildings. The unit mix here is very family-friendly, with almost every unit being 2- or 3-bedroom, and many of them ground-oriented with access to a large public courtyard and parks.

Council voted unanimously to consider issuance of the Development Permit.

404 Ash Street Development Permit and Housing Agreement

This is the plan to replace the building lost to fire at 4th Ave and Ash in February, 2014. The rental building had 29 units, and will be replaced with a slightly larger building featuring 38 units, and will be a secured rental building.

In Committee of the Whole, I asked that we have staff report back to us prior to the DP being issued about the potential to save the row of about 18 trees that line the north side of the property.

These tall, mature evergreens trees were impacted by the fire, but survived and appear now to be healthy – they even came through last weeks’ windstorm without a scratch.

They are essentially limb-free for the bottom 25 feet, but have healthy crowns that rise to probably 50 feet. Besides all of the community amenities trees provide in regards to the sustainability of our community, this particular line of trees provide an incredible weather buffer to the apartment building to the north – shading the three-story walkup from the worst of the summer heat, and reducing wind and noise.

The trees are planted just within the property line of 404 Ash, and are prospering despite only taking up about 3 feet of soil between the driveway to the north and the excavated underground basement foundations of the building that was burned. It would be a shame if we lost these trees now. It would be a loss to the Brow of the Hill community that lacks tree coverage, to the neighbours to the north, and ultimately to the residents of this new rental building (as was pointed out recently in a news story).

The trees look healthy to me, but I am not an arbourist. Therefore, I asked that Staff provide us a bit of guidance about the viability of these trees, and to opine on whether they could be saved. If the new building’ footprint is going on top of the foundation footprint of the old building, then the trees should not be effected, and just might need a bit of protection during construction. If the planned foundation of the new building is closer to the north property line than the existing building, then I would even be happy to see the entire building shifted 3 feet south to allow these trees to remain for the entire neighbourhood.

I don’t want to hold up this development, I just want to assure that every possible step was taken to protect these trees, so they are not lost out of general neglect of their benefits.

Council will be reviewing this Development Permit at the September 14 meeting.

Queensborough Special Study Area – Consultation and preliminary zoning

Council was asked to approve an ongoing consultation plan on the comprehensive redevelopment of a large area of Queensborough. The plan outlines the stakeholders that must be consulted under the Local Government Act (like Metro Vancouver), and those that probably should be consulted (Port Metro Vancouver), along with the next stages of public consultation, especially with property owners within the Special Study Area.

This is a large redevelopment, which will bring a commercial hub to the east part of Queensborough adjacent to Port Royal, along with residential development of family-friendly ground oriented housing. I attended a Publci Open House at the Queensborough community Centre back in June, and the reception we generally very positive about this development. There were a few traffic-impact details to work out at that time, but the most frequent comment I heard was “how soon can we get those stores?” There is a real desire to get a bit of local retail around Port Royal, and I hope it can be built early in this development plan, if the plan is approved.

There are more details to be worked out yet, but Council is happy at this point with moving the project ahead to the next steps.

800 12th Street, Text Amendment to Zoning Bylaw

A business wants to move their operation to New Westminster at 12th St. and 8th Ave, but the strict wording of our Zoning Bylaw does not allow part of their business plan. They currently offer a variety of pet services, but boarding for cats is one of them, and that does not fit the zoning of the property. There are several steps to make the required change to the Bylaw, including informing neighbours, committee review, and Public Hearing. Council is happy to allow the process to proceed as required by the Bylaw and the Local Government Act.

Street and Traffic Bylaw changes

We moved 3 readings of the changes to our Street and Traffic Bylaw back on July 13th, but before it is adopted, the Bylaw needs to pass Ministry of Transportation and Infrastructure muster – one of those gentle reminders that Local Governments and Municipal streets exist at the pleasure of the Provincial Government. The MoTI review found our definition of “street” was not strictly appropriate, and needed a bit of modification. No problem there, but to make the change we need to rescind our original Third Reading and replace it with a Third Reading of the text of the Bylaw that reflects the new definition.

Yes, this all makes perfect sense, although it is a pretty good argument for why Government can’t just “run more like a business”. Checks and balances, my friends. Checks and balances.

2014 Annual Water Quality Report

There has been a lot of talk this year about water quantity, but not as much about water quality. The water that comes out of your tap is remarkably clean, and we take extraordinary measures to assure it is some of the cleanest, safest water in the world. Our Water crews in the City and our supplier the Greater Vancouver Water District do excellent work, and it is something we should trumpet more. If nothing else, we should use it to point out the silliness of paying for bottled water.

This annual report is the public disclosure of how, where and when the 966 water samples for 2014 were collected, and the detailed results of their analytical testing. Data geeks might want to have fun there, but for everyone else- the water is safe, and we are going above and beyond the requirements to assure it stays that way.

Sewer separation budget re-allocation

If you noticed all the digging activity along Queens Street near Tipperary Park of late, that is part of the ongoing “sewer separation” program, where the City’s archaic combined-flow sewers are being replaced with separate sanitary and storm systems. A legacy of being a very old city, and a lack of infrastructure investment in previous decades, much of New Westminster’s sewers still combine storm flows with sanitary flows, which means our sanitary system carries more water than it needs to, treatment costs are high, and occasional very large storm events can result in sanitary sewer spills. Replacing these systems City-wide is a decades-long process that will cost the City hundreds of millions of dollars – we do what we can when we can.

In this report, Engineering is asking Council to approve a plan to accelerate separation in an area of Sapperton where there are current plans to pave and install gutter/drain systems. It makes sense to do the separation at the same time – you only have to tear the road up once, and you are not hooking your new surface works to obsolete infrastructure. So Council approved the plan to move some money over to facilitate this and save us money in the long run.

Update 2016 Budget Survey

The City commissions a survey every year as part of our outreach efforts during the budgeting process. The questions are very opinion-poll-like (“What do you like more or less about the City? Where do you think we should put more/less emphasis?”), but the study has been asking similar questions for several years, so longitudal trends can be tracked. This report was just a final “OK” on the survey questions from Council before the poll is commissioned.

Sole Source Multi-year Maintenance Agreement

The City has enterprise software it purchases from a large company. That software is proprietary, and requires regular maintenance. We need to pay the supplier for that maintenance, as no-one else can do it. Our purchasing Policy requires that only Council can authorize sole-source procurement for the necessary ~$150,000 per year spent on this software system. We did so.

Front Street Public Art Installation

Back in July, Council decided it didn’t like the Public Art proposal for the Front Street Parkade that we chosen by an independent jury of professionals working under the guidance of the Public Art Advisory Committee. So the project was punted back to Staff and Committee to come up with a better proposal.

This is a topic where I respectfully disagree with some of my Council colleagues, in that I think that judging the aesthetics or artistic merit of Public Art is not the role of politicians (as wise and intelligent as we may be). I won’t go into this at length here (another blog post, another time – a short version can be heard in my comments at Committee of the Whole). Regardless, I agree with the idea that we need to get the PAAC involved and get a project approved for this site.

Capital Budget amendment

The NW Police Department needs to renovate its space to reflect the results of their successful recruiting of female members. The Old Boys Club needs a few more lockers for the New Girls. This approval by Council is a preliminary step towards the NWPD including the improvements in their Capital Plan, and securing cost estimates. Council will once again be able to opine on the project once some more detailed costs and timing are worked out.

Rental Displacement Policy

This is a topic I brought before Committee of the Whole for consideration. I wanted to hear how the City’s existing rental protection policies and practices, and those of the provincial Residential Tenancy Act are working to protect individuals who are living in the City’s rental properties. I also want the report to identify potential policy gaps, and how we could do better.

There have been a couple of events recently that have raised the profile of people displaced from affordable rental accommodation. During the Urban Academy debate in the spring, there was a situation created where residents of a Manitoba Street residential building were evicted in preparation for a development that was (in the end) not supported by Council. During those discussions, it was clear that the proponent felt they took measures well above and beyond to help the displaced residents, however it was also clear that some of the families that were displaced suffered tremendously, and felt that their rights were not respected by the proponent or by the process. I also had a conversation a few weeks ago with a neighbour who knew of two other men who were being displaced right now by a new small residential development in the West End.

There is increasing media attention in some of our neighbouring communities around “renovictions” and loss of affordable and rental housing that results from rapid development (especially around SkyTrain stations) and our rapidly increasing cost of housing.

There are already some policies in place in New Westminster to prevent the loss of rental properties and to reduce the impact on affordability that comes with redevelopment, but I think it is timely for us to review the policies and have a closer look at provincial and municipal standards compared to the expectations we have as a City about how rental property and affordable housing will be protected as our building stock is updated.

After all of that Committee of the Whole action, we had a few Bylaws to read:

Zoning Amendment No. 7779, 2015

Housekeeping changes to the Zoning Bylaw mentioned above, Received First and Second reading.

Housing Agreement Bylaw No. 7775, 2015

The agreement that assures this development will be secured for rental, also mentioned above, received First, Second and Third Reading.

Street and Traffic Bylaw No. 7664, 2015

The changes made by the Ministry (mentioned above) required rescinding of Third Reading and a new Third Reading.

And that was an evening’s work.