The 2019 annual meeting of the Federation of Canadian Municipalities (FCM) was held in Quebec City at the end of May. I attended along with one other Councillor from New West and more than 2000 other delegates from across Canada. Here is a short version of what I saw during an action-packed three days.

Sessions:

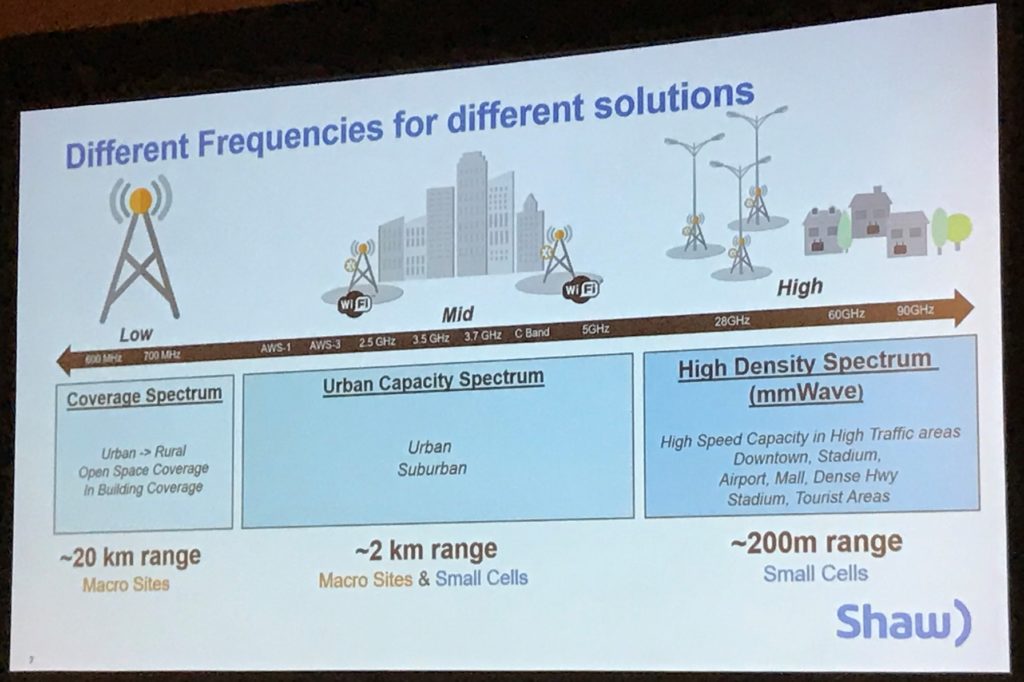

The meat of any professional conference is the workshop sessions, where we can learn about the best practices, new ideas, and challenges of other municipalities across the country. I attended sessions all three days, including ones on the challenges and opportunities coming out of the upcoming federal election (read: funding!), the FCM National Funding Program update, 5G implementation, building diversity on our Councils, Smart City applications, and addressing affordable housing.

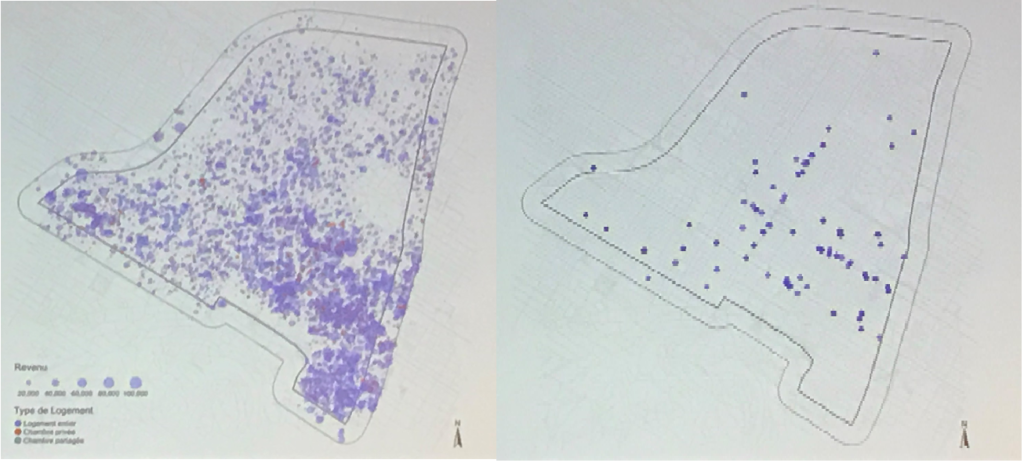

There was a lot there, but the last session was perhaps the most compelling, with a researcher from McGill talking about Short Term Rentals, their impact on Le Plateau neighbourhood of Montreal, and the challenges that City has run into in attempts to regulate it while their rental vacancy dips below 1%. It was compelling, and somewhat challenging…

Business:

These conferences also feature an AGM, where a few organizational Bylaw changes were discussed. Getting bylaw changes and annual financial reporting though with a delegation of more than 1500 people in the room was handled deftly by the table executive, using remote voting devices.

These devices were also used for voting on Resolutions. Compared to the UBCM or Lower Mainland LGA, there were very few resolutions, and most of them were aspirational asks more than specific requests for regulatory changes (cities are “creatures of the provinces”, so our regulatory interface with the federal government is slightly filtered). However, with minor amendments, all 9 resolutions were passed by the Membership.

Politics:

We had speeches from the leaders of 4 Federal Parties, all trying to sell their vision for how the Federal Government and local governments can work together – and why their success in the upcoming election is paramount to that. In the order they appeared:

The Prime Minister, unless I missed it, never referenced the leader of the Conservative Party, but at least twice directly referenced the suddenly-not-popular Doug Ford. Hard to tell if he was just trying this out because of recent news, or if this is the strategy, but the short message is: If you vote for the Conservatives, Scheer will do what Doug Ford is doing, and will cut funds to local governments for the services you need. Other than that, he attaches himself to popular mayors in the audience, promises to work closely with Cities, and not let pesky provinces get in the way (which is probably another shot at Kenney and Ford, but seems a challenge to our model of Federalism).

Scheer’s speech was a long exercise in coded words and dogwhistles, but in the end I guess they all are. He fears infrastructure funding will lead to deficits (strange thing to say to 2,000 municipal leaders looking for handouts), never mentions climate (though he does care deeply about the environment), but he hates the Carbon Tax because it “punishes innocent families”. His approach to housing is to let the market do its thing with less red tape (ugh, the market is what got us here!), and his solution to the opioid crisis is to somehow “hold China accountable..” I might say the entire thing was ugly, ignorant, and offensive, but I may betray my bias.

Jagmeet Singh was the first leader to open with a land acknowledgement, and the first to speak without a teleprompter. He had notes, but riffed off of them freely. His speech was good if unpolished. He promised a lot (pharmacare, broadband, infrastructure funding, removing barriers to post-secondary education), but to me the most telling part was that he was the only leader to link climate action to inequality and the need for a just transition away from fossil fuels. That was the message I wanted to hear (and increasingly, that is the message among people looking for climate action in Canada), and he delivered it clearly without equivocation.

Jagmeet Singh was the first leader to open with a land acknowledgement, and the first to speak without a teleprompter. He had notes, but riffed off of them freely. His speech was good if unpolished. He promised a lot (pharmacare, broadband, infrastructure funding, removing barriers to post-secondary education), but to me the most telling part was that he was the only leader to link climate action to inequality and the need for a just transition away from fossil fuels. That was the message I wanted to hear (and increasingly, that is the message among people looking for climate action in Canada), and he delivered it clearly without equivocation.

Elizabeth May was the last speaker, she also opened with a land acknowledgement, and spoke without notes at all, best I could tell. Though the eldest leader, she spoke more than others about the need to listen to the youth and the duty we have to them (a very different message than the Trudeau and Scheer platitudes about “supporting families”). She spoke passionately about the Climate Emergency, and drew allusions to Dunkirk and Churchill. Though her speech lacked the substance of the other leaders, she was easily the most inspiring of the speakers.

If you want to watch the speeches yourself, you can scroll down the FCM Facebook page, where they were live streamed and are still available.

Overall:

FCM is a funny bird. It is much larger than our regional and provincial associations, and much like the Federal government, it at times seems disconnected from the day-to day. Though the message is reinforced all along that the Feds care about local government, and how local government is the order of government that has the most connection to people’s every day life, the FCM runs the risk of being too far from our everyday as to sometimes challenge me to think about local applications.

Jagmeet Singh made the comment during his Q&A that his father used to say “If the Federal government stopped working today, no-one would notice for a month, The provincial government might be missed after a week or two, but if the local government went way, you would notice almost immediately.” Water, sewer, roads, waste, parks, these things we interact with so ubiquitously that we take them for granted, and because in Canada we tend to deliver them really well, we take the system that delivers them for granted.

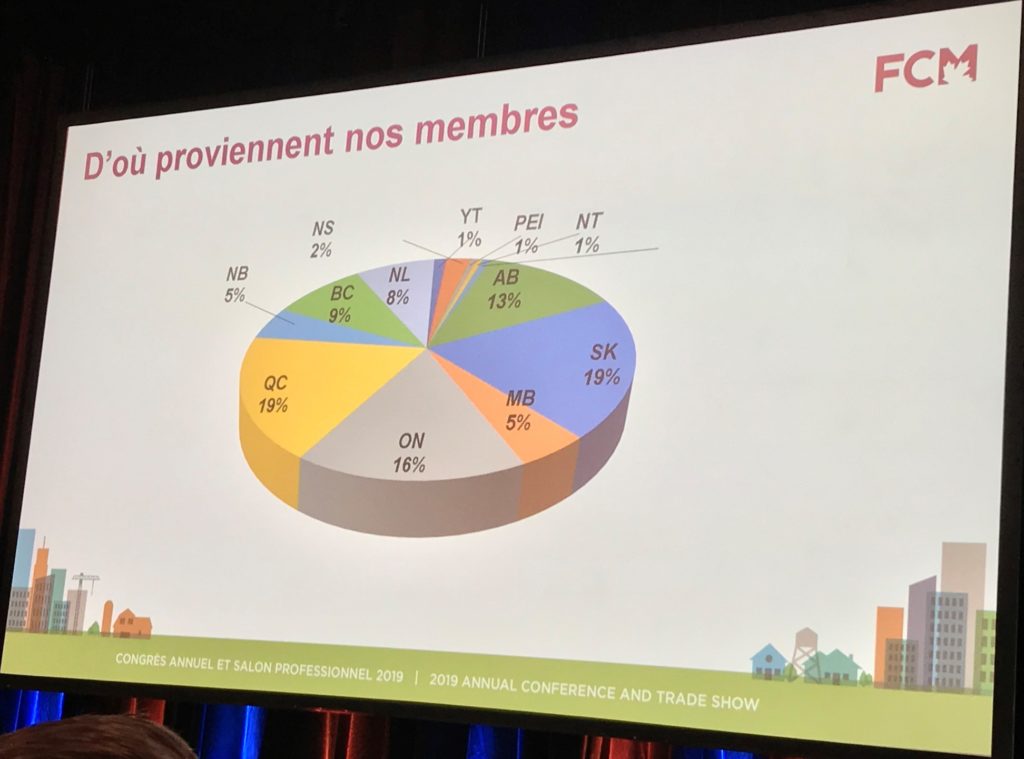

Part of the peculiarity of FCM is that it is a strangely rural conference. Canada has never been as urban as it is now: our biggest cities are growing fast, and our small towns are (with some notable exceptions) stagnant or hollowing out. Yet the 2,000+ delegates at FCM overwhelmingly represent smaller towns and rural areas. There are more members from Saskatchewan than from any other province, and the three Prairie Provinces have more members than Quebec and Ontario combined: Breakdown of the number of UBCM members by province, which clearly does not correlate with population.

Breakdown of the number of UBCM members by province, which clearly does not correlate with population.

Therefore the issues of rural areas (e.g. unmet demand for Broadband service) dominate the conversation over the issues of urban areas (e.g. unmet demand for public transit). There is a “Big Cities Mayors Caucus”, and I’m sure Naheed Nenshi gets more access to Trudeau than the Mayor of Podunk, Saskatchewan, but at the delegate level, the imbalance is palpable.

This was perhaps made more distinct by the phenomenon of organized (and no-doubt industry-sponsored) campaigns to get the “Support Fossil Fuels” message across getting larger every year. A booth handed out literally thousands of “Support Canada’s Energy” t-shirts, which was no doubt a challenge to the continued efforts at FCM to get the federal government to help local governments shoulder our disproportionate burden for greenhouse gas mitigation and climate change adaptation. We may have been at a bilingual conference in Quebec City, but Canada’s Two Solitudes are divided on different lines today than they once were:

So perhaps the most inspiring meeting of this year was an impromptu meeting organized by Rik Logtenberg, a new Councillor for Nelson BC to start a “Climate Caucus”. A group to coordinate local government calls for support in addressing the Climate Crisis. It was not part of the regular program, but was spread by word-of-mouth, and we had a packed room (standing room only!) representing a diversity of Canada. No free industry-supplied t-shirts, just people getting together to talk about shifting our thinking and supporting each other in the tough work ahead:

In the end, that is the best part of taking an opportunity like FCM – the power of networking formally and informally with elected officials across the nation that are trying and doing and sometimes failing the same way you are, so we can learn together. Scheming over beers has always been a powerful force for change.

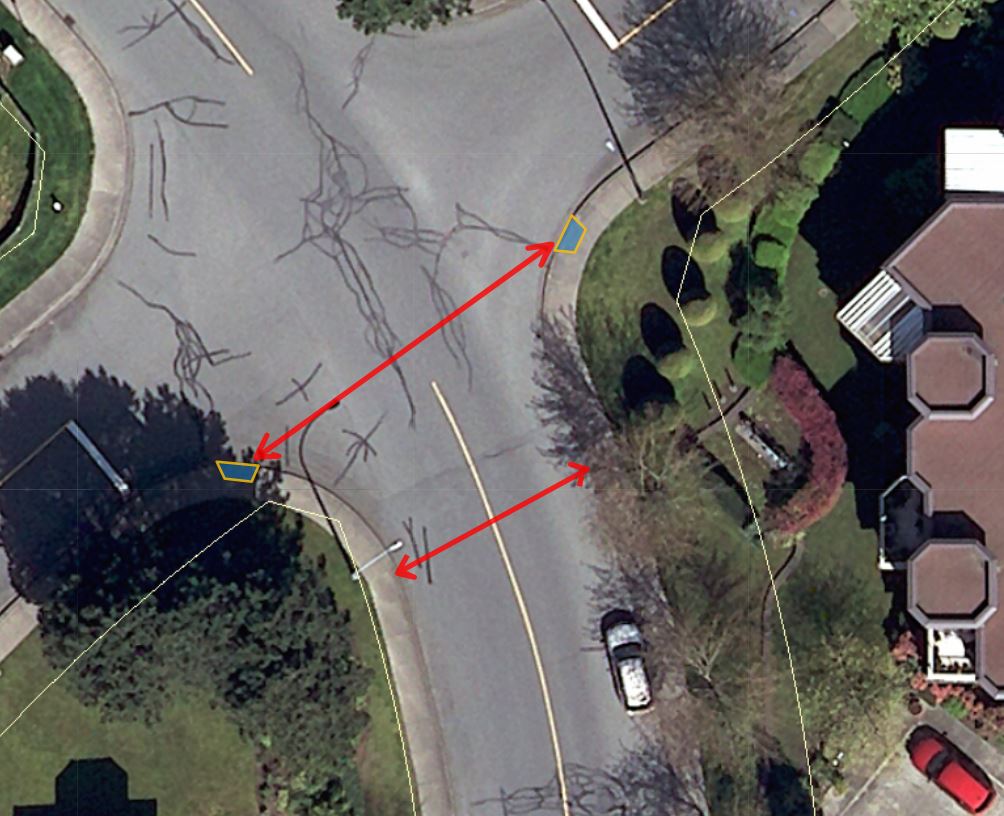

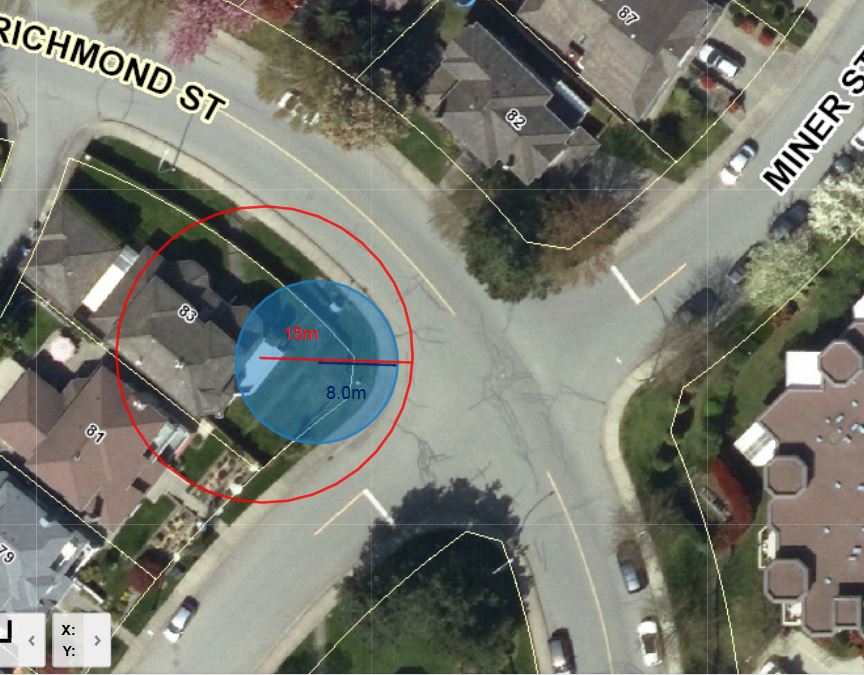

But that is just a representative cross section. There is another issue that makes the pedestrian experience even more uncomfortable. If you look at the intersection of Richmond and Miner, where staff were asked to evaluate placing a crosswalk, you see the corners are rounded off to facilitate higher turning speeds:

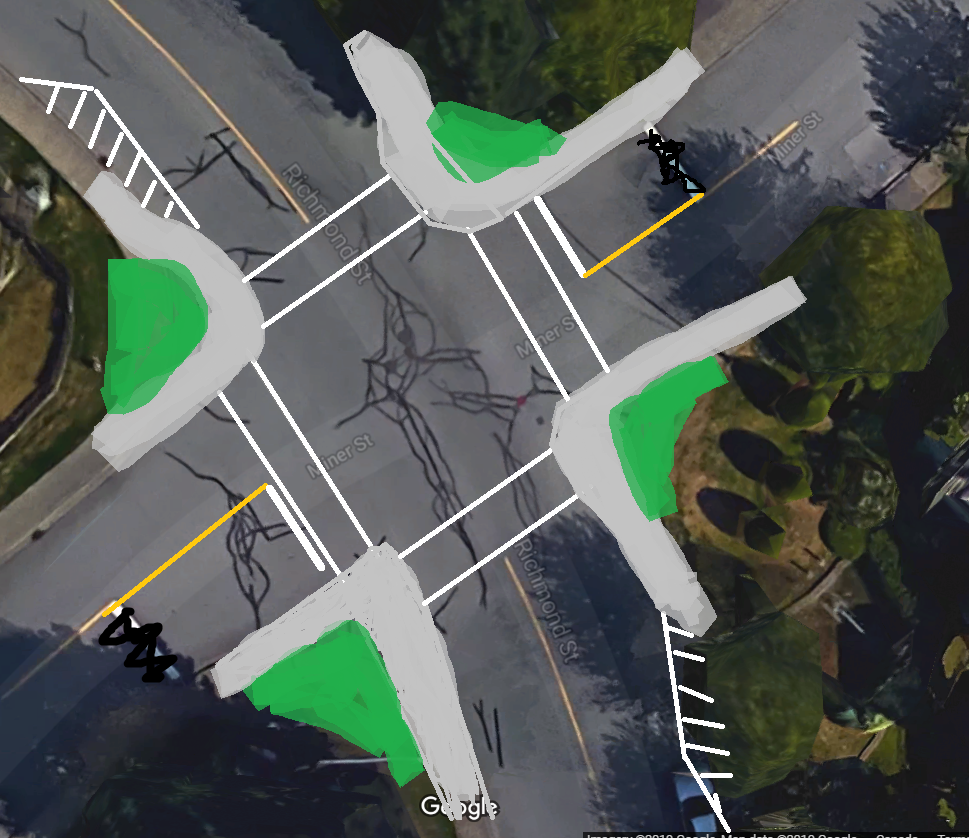

But that is just a representative cross section. There is another issue that makes the pedestrian experience even more uncomfortable. If you look at the intersection of Richmond and Miner, where staff were asked to evaluate placing a crosswalk, you see the corners are rounded off to facilitate higher turning speeds: The technical term for this shape is “Corner Radius”. In this diagram you can see the curb follows a curve with a radius (blue) of about 8m, and the effective turning radius (tracing the track a vehicle would actually use for a right turn) is closer to 15m. By modern standards, this is a crazy wide corner, more suited for a race track than an urban area. Reading up on

The technical term for this shape is “Corner Radius”. In this diagram you can see the curb follows a curve with a radius (blue) of about 8m, and the effective turning radius (tracing the track a vehicle would actually use for a right turn) is closer to 15m. By modern standards, this is a crazy wide corner, more suited for a race track than an urban area. Reading up on